Chinese Hyper-Scale Operators Lower Data Center Spending As Amazon, Google And Microsoft Double Down

‘The drop-off in spending in China has been so marked that an otherwise strong worldwide growth story has been transformed into a modest Capex decline,’ says John Dinsdale, a chief analyst at Synergy Research Group.

All of the major large-scale data center operators in China reduced their spending in the second quarter of 2019, leading to the second consecutive quarter of data center Capex decline, according to new data from Synergy Research Group.

John Dinsdale, a chief analyst at Synergy Research Group, said Amazon, Apple, Google, Facebook and Microsoft typically dictate the scale and trends of large-scale, also known as hyper-scale, data center Capex growth.

“But the drop-off in spending in China has been so marked that an otherwise strong worldwide growth story has been transformed into a modest Capex decline,” said Dinsdale.

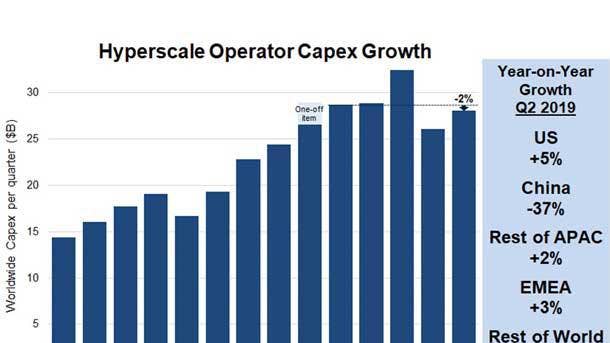

Hyper-scale operator Capex in the second quarter of 2019 hit $28 billion, down 2 percent year over year compared with the record-setting levels of 2018. The $28 billion in second-quarter spending was higher than the $26 billion spent by hyper-scale operators in first-quarter 2019.

[Related: Potential Sale Of Data Center Provider CyrusOne Sends Stock Soaring]

The main factor that held back Capex growth in China was that the region’s four main players—Alibaba, Tencent, JD.com and Baidu—all reduced their spending substantially.

Chinese hyper-scale spending was down a whopping 37 percent year over year. Looking at the worldwide market growth in second-quarter 2019, U.S. spending increased 5 percent year over year, EMEA was up 2 percent, and the rest of Asia-Pacific—excluding China—increased 2 percent as well.

“If we take China out of the data, then hyper-scale Capex grew 4 percent over the record-setting levels seen last year,” said Dinsdale. “The situation in China is likely to be a short-term phenomenon as the four Chinese hyper-scale operators continue to grow revenues more rapidly than their U.S.-headquartered counterparts. After some short-term financial belt-tightening, we expect to see Chinese Capex rise strongly once again.”

Similar to the past several quarters, the top five worldwide hyper-scale spenders in the second quarter were Amazon, Apple, Google, Facebook and Microsoft. In aggregate across Google, Amazon, Microsoft, Facebook and Apple, second-quarter Capex increased 7 percent.

Synergy’s data center numbers are based on analysis of the Capex and data center footprint of the world’s 20 major cloud and internet services firms including Amazon, Alibaba, Apple, Google, IBM, Microsoft, NTT and Tencent. The majority of Capex spending goes toward building, expanding and equipping huge data centers, which now total nearly 470 facilities globally.

The data center market is transforming rapidly with the rise of software-defined data center technology and the shift toward the cloud. This is leading to a massive amount of data center acquisitions.

In the first half of 2019, an astounding 52 data center-oriented acquisitions closed, up 18 percent year over year. As businesses move infrastructure to co-location facilities and the cloud, more and more data centers are being put up for sale and are being bought by co-location providers.

Some of the largest data center hardware and software providers are feeling the impacts of the U.S.-China trade war. This month, Cisco Systems CEO Chuck Robbins told investors during the company’s fourth- quarter earnings call that business in China has fallen. Cisco, the global leader in data center networking, reported revenue in China was down 25 percent year over year.

“What we’ve seen is in the state on enterprises ... we’re just being uninvited to bid,” Robbins said. “We’re not being allowed to even participate anymore.”