NetApp Shakes Up Cloud Portfolio After ‘Strategic Review’

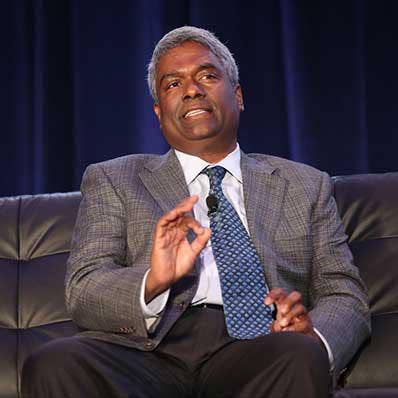

‘We aligned our cloud sales specialists to our hyperscaler partners’ go-to-market structures at the start of the fiscal year and are seeing new customer additions and growth in those services,’ says NetApp CEO George Kurian.

Storage vendor NetApp is making significant changes in its cloud product portfolio by eliminating some of its services and moving others to be more aligned with public cloud storage services.

George Kurian, CEO of San Jose, Calif.-based NetApp, Tuesday said during his prepared remarks to financial analysts during the company’s second fiscal quarter 2024 quarterly financial conference call that NetApp’s priority remains growing first-party cloud storage services.

“We aligned our cloud sales specialists to our hyperscaler partners’ go-to-market structures at the start of the fiscal year and are seeing new customer additions and growth in those services,” Kurian said. “However, that growth has been masked by weakness in subscription services, which have declined to 23 percent of public cloud ARR [annual recurring revenue].”

[Related: NetApp CEO: Cloud, Flash Storage, AI Innovations Will Lead To Growth]

During the second fiscal quarter, NetApp engaged in a “strategic review” to sharpen its cloud portfolio focus, Kurian said.

“As a result, we will continue to prioritize cloud storage offerings delivered through the hyperscalers while refocusing some services, such as Cloud Insights and Instaclustr, to complement and extend our hybrid cloud storage offerings, creating greater differentiation and additional value for customers,” he said. “We will integrate other services that are sold as stand-alone subscriptions today, such as data protection, into the core functionality of Cloud Volumes.”

NetApp will also carefully manage the transition of cloud storage subscription services to align to customers’ preference for consumption offerings, and has decided to exit the SaaS backup and virtual desktop services business, Kurian said.

“We anticipate ARR headwinds of approximately $55 million from exited services and unrenewed subscriptions in the second half of FY ’24,” he said. “Growth in first-party and marketplace services are expected to partially offset this decline, positioning us to enter FY ’25 with a more focused and much healthier business from which to grow.”

For its second fiscal quarter of 2024, NetApp saw public cloud segment revenue grow by 8 percent over its second fiscal quarter 2023, Kurian said. The company’s first-party and marketplace services revenue grew over 30 percent during the same period, he said.

“We continue to see customer expansion and deepening partnerships as well as increases in customer count, capacity, revenue and ARR in this part of the portfolio,” he said.

With the introduction in the second fiscal quarter of 2024 of Google Cloud NetApp Volumes, NetApp is not just the only vendor to have a natively integrated storage service in the public cloud, Kurian said.

“We are natively integrated into all three of the leading hyperscale vendors,” he said. “And we are not standing still with this advantage. Just two months after introducing the GCNV service, we announced the availability of a new lower-cost tier of Google Cloud NetApp Volumes, expanding the offering to address a greater range of workloads.”

These partnerships uniquely position and enable NetApp to participate in the innovation and adoption of AI services in the public cloud, Kurian said.

“As examples, during Q2, we announced support for Google Cloud’s Vertex AI with Google Cloud NetApp Volumes, as well as cross-protocol, hybrid cloud AI pipelines on Amazon FSx for NetApp OnTap with support for SageMaker Studio notebooks,” he said.

The second fiscal quarter of 2024 improved on NetApp’s solid start to the fiscal year despite a continuing challenging macroeconomic environment, Kurian said.

“We remain relentlessly focused on managing the elements within our control while driving better performance in our storage business and building a more focused approach to our public cloud business,” he said. “We are seeing positive results from these actions, with increased profitability and a stronger position for delivering long-term growth.”

NetApp is at the forefront of the storage industry evolution, helping businesses turn disruption into opportunity with intelligent data infrastructure, Kurian said.

“Today’s organizations need storage infrastructure that harnesses the power of public and hybrid clouds while keeping data secure and protected from ransomware attacks,” he said. “They need infrastructure that supports dynamic workloads like AI, cloud-native and open-source applications. And they need infrastructure that helps to create more sustainable data centers.”

NetApp provides an entire architecture of unified data storage solutions based on one operating system, OnTap, that supports any application and any data type while spanning on-premises and multiple cloud environments, Kurian said.

“Intelligent data infrastructure combines unified data storage, integrated data services and intelligent operations so customers can operate with seamless flexibility to deploy new applications, unify their data for AI, and simplify data protection in a world of limited IT resources, rapid data growth and increased cybersecurity threats,” he said.

NetApp And AI

When asked by an analyst after the prepared remarks about how AI is impacting NetApp’s business, Kurian said the company has been in the predictive AI and industrial AI business for five years.

“There are large data sets that are built out to support training of those models and the implementation of those models across the enterprise,” he said. “So we have a good and robust business there. We are starting to see early signs of trials and use cases with generative AI. Generative AI is particularly well suited for NetApp capabilities because it operates on unstructured data, files, documents, video, audio and so on. And so we have large repositories of those customers. And we are able to use that data set and add to that data set to support AI use cases.”

When asked about the growth of the flash-based storage business, Kurian said NetApp saw the high-performance storage business move to flash several years ago, and that flash now accounts for maybe 20 percent of the overall storage market.

“The next tranche of use cases are more in the general-purpose application footprint,” he said.” These are in the process of migrating over multiple years. We are in the early innings of that migration. And so we feel very good about the position of our flash portfolio to attack that part of the market.”

NetApp By The Numbers

For its second fiscal quarter of 2024, which ended Oct. 27, NetApp reported total revenue of $1.56 billion, down about 6 percent from the $1.66 billion the company reported for its second fiscal quarter of 2023.

This included product revenue of $706 million, down from last year’s $837 million; support revenue of $623 million, up from $607 million; professional and other services revenue of $79 million, up from $77 million; and public cloud segment net revenue of $154 million, up from $142 million.

Of the product revenue, hardware accounted for $308 million, down from $342 million, while software revenue accounted for $398 million, down from $495 million.

Americas revenue accounted for 50 percent of total revenue, down from last year’s 51 percent. About 77 percent of sales were via indirect channels, flat with last year.

Total revenue beat analyst expectations by $30 million, according to Seeking Alpha.

For the quarter, NetApp reported GAAP revenue of $233 million, or $1.10 per share, down sharply from last year’s $750 million, or $3.41 per share. On a non-GAAP basis, NetApp reported net income of $344 million, or $1.58 per share, up from $326 million, or $1.48 per share.

Looking forward, NetApp expects third fiscal quarter 2024 revenue of $1.51 billion to $1.67 billion compared with last year’s $1.53 billion. The company also expects GAAP net income of $1.17 to $1.27 per share, and non-GAAP net income of $1.64 to $1.74 per share. This compares with third fiscal quarter 2023 GAAP net income of 30 cents per share and non-GAAP net income of $1.37 per share.

For all of fiscal 2024, NetApp now expects revenue to fall about 2 percent compared with NetApp’s fiscal 2023. The company also expects GAAP net income of $4.15 to $4.35 per share, and non-GAAP net-income of $6.05 to $6.25 per share. This compares with fiscal 2023 GAAP net income of $5.79 per share and non-GAAP net income of $5.59 per share.