The 10 Top IT Channel News Stories Of 2020

For good or for bad, 2020 saw the channel step into the limelight in a way it hadn’t before as clients found themselves dependent on solution providers as they looked for flexibility in dealing with a global pandemic, cybersecurity attacks, and more.

2020: Unforgettable, No Matter How Hard We Try

It is nearly impossible to look back at the year 2020 without disappointment. Issues ranging from a global pandemic to massive ransomware and cybersecurity attacks left a lingering taste of fear and misery on the channel and its clients. However, as the old saying goes, when life gives you lemons, make lemonade. And that’s what the channel did in 2020.

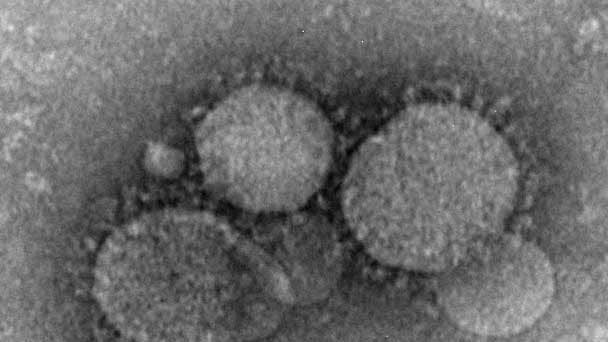

One cannot dispute the importance of the COVID-19 pandemic’s impact on the channel, which caused the IT industry to reassess how it interacts with clients and employees. Yet it was only one of the story lines to have a major impact on solution providers this year as some extremely serious security issues reverberated through the channel, and indeed brought the concept of the channel and managed service providers into the spotlight.

Yet 2020 was a time for the channel to shine as solution providers worked tirelessly to give clients flexibility to weather the storm of the pandemic and other issues and help them build their businesses for the future.

For a look at the top IT channel news stories of 2020 and their impacts, read on.

CRN’s Rick Whiting, O’Ryan Johnson, Dylan Martin, Gina Narcisi, Kyle Alspach, Mark Haranas, Steve Burke, and Michael Novinson contributed to this article.

10. Channel Embraces UCaaS

One of the most immediate impacts of the COVID-19 coronavirus pandemic, and probably the one with the longest future impact, was the move by businesses to embrace unified communications, particularly videoconferencing, as a mainstream technology. As businesses sent their employees home to work remotely as a way to help slow the spread of the coronavirus, they needed a way to help ensure those workers could continue collaborating. And the channel responded with a massive push to make platforms such as Zoom, Microsoft Teams, and Cisco Webex essential viewing for their clients.

The pandemic quickly created unparalleled opportunities for solution providers to drive sales of the collaboration and unified communications-as-a-service, or UCaaS, technologies while bringing their own services into play. As a result, videoconferencing as a service became ubiquitous as people across the U.S. rearchitected their lives to work, learn and receive health care from home, and the word “Zoom” entered the national lexicon as synonymous with videoconferencing. Microsoft said that by late April, Teams usage had rocketed past 75 million daily active users, which was four times the base of the previous November.

9. New Channel Chiefs Emerge

2020 saw new executives step up to take over the key channel chief role at several large IT companies and in the process look for ways to help those companies expand their relationships with the channel community.

Dell in August brought back Rola Dagher, a former Dell executive who left the company for three years to act as president of Cisco’s Canadian operations, to serve as its new global channel chief where she now leads Dell Technologies’ global channel partner strategy, vision, enablement, program design and partner experience. She took over a month after long-time Dell channel chief Joyce Mullen left.

Hewlett Packard Enterprise in September named George Hope as its new worldwide channel chief after his predecessor, Paul Hunter, was promoted to managing director of North America. Hope, who for the last three years has been HPE’s vice president of worldwide distribution, told CRN he is focused on HPE’s edge-to-cloud Platform-as-a-Service vision with the goal of moving the entire HPE product portfolio to as a service by 2022.

Verizon in December appointed Wendy Taccetta as the first channel chief of its Verizon Business Group in three years. Taccetta, a 20-year Verizon veteran and most recently the carrier‘s senior vice president of global commercial operations for Verizon Business, is overseeing channel strategy, operations and sales enablement for all partner programs across Verizon‘s entire business.

Lenovo in January appointed 30-year industry veteran Steve Biondi, who has held various top channel and sales roles for the likes of Avaya, Oracle, VMware, and IBM, to be its new channel chief.

Meanwhile, VMware in July brought in former Cisco executive Sandy Hogan as its new channel chief.

The influx of fresh channel talent in these key roles and others will have a significant impact on channel strategy in the new year.

8. Channel Consolidation: Full Speed Ahead

2020 was a big year for MSP acquisitions from the very start. During the first week of the year, at least three private equity companies invested in or acquired MSPs, including Boston-based M/C Partners, which acquired the managed services portion of West Monroe Partners; Dallas-based Trinity Hunt Partners, which acquired Dataprise; and New York-based One Equity Partners, which invested in CDI.

The year was big for MSPs being acquired by their peers. This included the February acquisition of Information Technology Partners by Fitchburg, Wisc.-based Gordon Flesch; the July acquisition of Bright Bear Technology Solutions by Modesto, Calif.-based Datapath; the October acquisition of Timlin Enterprises by Foxborough, Mass.-based Thrive; and the November acquisition of MSP Sinu by New York-based Electric;

It was also a big year for acquisitions of more traditional solution providers, some of which were purchased by their peers while others were acquired by vendors or private equity firms.

When it came to regional solution providers, San Antonio, Texas-based Sirius Computer Solutions, which in 2019 sold a majority stake to a private investment firm, made two significant acquisitions in 2020: Champion Solutions Group in December, and Advanced Systems Group in May. Another large solution provider, Chicago-based AHEAD, which is Dell’s largest data center partner, made three acquisitions in 2020: Platform Consulting Group, RoundTower, and Kovarus.

The year also saw Presidio acquire Coda Global, Evotek acquire Mystic River, Trace3 acquire Groupware Technology, Globant acquire digital transformation services provider gA, Cognizant acquire Microsoft specialist New Signature, U.K.-based Computacenter acquire U.S.-based Pivot Technology Solutions, and Texas-based General Datatech expanded California with the acquisition of Integrated Archive Systems.

At least one vendor, IBM, acquired a solution provider, in this case SAP partner TruQua. And then there’s Accenture, which in 2020 made at least 20 acquisitions, most of which were smaller solution providers.

7. Datto: IPO And Questions

MSP platform provider Datto in September filed for its IPO with the ticker symbol “MSP” to reflect the channel-specific nature of its customer base. Datto’s IPO was one of the biggest IPOs of 2020 at nearly $600 million, giving the Norwalk, Conn.-based vendor the ability to pay off debts and invest in new offerings.

Datto CEO Tim Weller in an interview with CRN on the day of the IPO said its stock market debut would give Datto new resources to help it continue to build the products and services that MSPs need to help customers with their digital transformation across storage, networking, security and other key areas of their business.

However, the IPO was not without issues as questions about Datto’s majority owner, Vista Equity Partners came to the fore in October when Vista Co-founder and President Brian Sheth stepped down from Datto’s board—and later from the company—after Vista CEO Robert Smith admitted to committing serious crimes in what federal prosecutors called a $2-billion tax fraud case. However, Weller told CRN that investors should not be concerned given that the company has a strong board of directors and a meaningful public investor base.

6. AMD’s Channel Awakening

AMD, the 51-year-old semiconductor company that has recently seen its share of the CPU market surpass 20 percent and is pushing hard into the GPU business, in 2020 made what for the company are historic investments in an effort to expand into the commercial PC and server markets, AMD President and CEO Lisa Su told CRN. This includes doubling market development funds, channel staff, and funded positions for top solution provider partners in 2021.

AMD priorities for 2021 are to expand direct coverage for national solution providers and establish coverage for regional solution providers focused on servers, as well as expand coverage for systems integrators in the federal space. This includes expanding investments in the number of technical positions it funds at solution provider partners as well as internal channel staff, and ramping up market development funds and its volume incentive rebate program, which in 2020 was expanded from its original focus on commercial PC sales to the server business.

5. Ingram Micro, Tech Data Catch Private Equity’s Eye

In 2020, two of the IT industry’s biggest distributors were involved in acquisition deals by private equity firms, a development likely to accelerate changes that IT distributors have been undergoing in recent years.

On Dec. 9, distributor Ingram Micro agreed to be acquired by Platinum Equity Partners in a deal valued at $7.2 billion. The acquisition, expected to close in early 2021, ends Ingram Micro’s four-year ownership by HNA Group, a Chinese company that has been hobbled by debt from a heavily leveraged acquisition binge.

Irvine, Calif.-based Ingram said the deal would provide the distributor with “added flexibility and resources to accelerate growth and execute on strategic initiatives.”

On June 30, private equity firm Apollo Global Management completed its $6 billion acquisition of Tech Data, taking the publicly held distributor private. The acquisition deal was originally unveiled in November 2019.

CEO Rich Hume has continued to lead Clearwater, Fla.-based Tech Data under its new ownership, and in September the distributor hired channel veteran Sammy Kinlaw as senior vice president of endpoint solutions for the Americas region.

The acquisitions could lead to distributors taking a longer-term view of the distribution market and provide more custom solutions for channel partners. With the backing of private equity heavy hitters, distributors are also better positioned to drive new value for leading solution providers.

4. COVID-19: Massive Impact On The Channel And Its Clients

The COVID-19 pandemic pushed the channel and the technology solutions it builds into the limelight as many customers scrambled to support a surge in work- and learn-from-home needs. And that led to a huge new dependence on their solution providers for help support a dispersed workforce with new IT equipment, new ways to collaborate remotely, and new ways to secure company data and operations.

The COVID-19 pandemic also led to massive changes in how channel partners ran their own businesses. For solution providers, that meant such moves as relearning to sell commodity hardware to clients who all of a sudden needed new laptops for their customers and pushing more heavily into as-a-service offerings to customers now working remotely.

Solution providers also saw massive changes in their own operations. The biggest disruption was learning to deploy new services and equipment, both for clients and for themselves, with minimal on-site presence in order to reduce the chance of technicians becoming infected. Channel partners also had to learn new ways to sell their solutions and services with the help of Zoom or Microsoft Teams, and especially with DocuSign. And, in an effort to stay afloat and keep employees working, they had to learn how to navigate government and bank red tape to take advantage of programs including the PPP, or Paycheck Protection Program.

Along the way, a bevy of technology vendors and distributors stepped up with flexible financing, incentives and other strategies to help partners push through the uncertainty.

3. MSPs And The Big Ransomware Attacks Of 2020

While 2019 became infamous for a series of ransomware attacks via MSPs that used ConnectWise Control as a means of infiltration, it was only the beginning as 2020 brought a massive increase in those attacks. The emerging threats to MSPs included ransomware developers insider threats from disgruntled employees, organized crime, nation-states and IoT hackers going through thermostats and cameras.

Another serious attack hit the channel early in the year when solution provider Cognizant crossed paths with Maze ransomware, which not only attacked the $16 billion company, but also some of its customers. Cognizant said its own internal security force was augmented by outside security contractors. The company also contacted federal authorities.

Unfortunately for both MSPs and small and midsize business clients, too many MSPs found themselves not equipped to handle a cybersecurity incident, with half of all MSPs that don’t have cyber insurance at the time of an attack going out of business while those who do may have to pay the ransom up-front before looking to insurance companies for reimbursement.

2. Everything-as-a-Service Offensive

Many solution providers spent much of 2020 ramping up their everything-as-a-service strategies as they sought new paths to profitability.

And they weren’t alone.

Ramping up its GreenLake offering was a huge focus in 2020 for HPE, following the company’s pledge the previous year to move its entire edge, core, cloud, software, and infrastructure business to an everything-as-a-service focus by 2022, giving its channel partners new ways to approach clients who are increasingly looking for infrastructure to be treated more like an operating expense than a capital expense. Several of its key competitors followed a similar path in 2020.

Cisco CEO Chuck Robbins in August said that the COVID-19 coronavirus pandemic has forced his company to re-examine its strategy and transition the majority of its portfolio to an as-a-service consumption model. The move, which will help Cisco cut about $1 billion in costs, will help Cisco better focus on cloud security, cloud collaboration, SD-WAN, and automation to drive simplicity and cost-effective network management. The company will also invest in 5G, Wi-Fi 6, next-generation silicon, and artificial intelligence, Robbins said.

Dell in September also pledged to move the vast majority of its offerings to consumption pricing and as a service, Dell Technologies CEO Michael Dell told CRN. This includes rolling out as-a-service consumption-based models for its massive portfolio of PCs, servers, storage, networking, end-user computing, and hyperconverged infrastructure offerings.

It is a move that is extending to specific parts of the data center infrastructure as well. Storage technology developer Pure Storage CEO Charlie Giancarlo, for instance, in September said his company, which sells only through channel partners, plans to lead the way in turning everything about data into a service.

1. SolarWinds And The Biggest Security Breach Of 2020

In a year characterized by a massive pandemic and a huge ransomware blitz, the last thing anyone needed in 2020 was a security hack via a commonly used networking monitoring tool. Yet that’s what 2020 brought to users of SolarWinds’ Orion networking monitoring technology, including tech giants, internet service providers, IT solution providers, federal agencies, and county governments. Hackers, likely from Russia, sometime during the year quietly hacked SolarWinds Orion to insert malicious code into legitimate software updates for the Orion software that allow an attacker remote access into the victim’s environment while blending into normal network activity and maintained a light malware footprint to help avoid detection. The attacks were very sophisticated, with attackers able to use Orion to breach other systems, including Microsoft and Azure.

Several solution providers, including Deloitte, Stratus Networks, ITPS and Netdecisions, were breached via SolarWinds and then specifically targeted by the hackers for additional internal compromise, according to cybersecurity consultancy Trusec.

The IT industry, and the channel, has not heard the last of the impacts of the SolarWinds breach.