8 Cloud Computing Trends In 2022: Overspending, Security And Workloads

From organizations spending between $1.2 million and $6 million on the public cloud on average, to where enterprises and SMBs are putting their workloads in 2022, here are eight big cloud computing trends based off a new cloud report by Flexera.

Eight Key Cloud Computing Figures And Survey Results

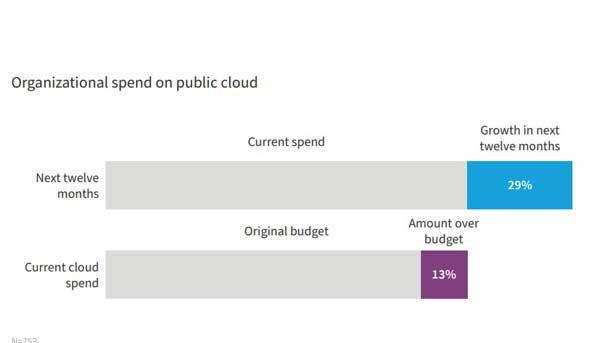

Enterprises and SMBs are flocking to the cloud in 2022 for a variety of reasons, with no slowdown in sight. This is despite businesses reporting being overbudget for cloud spending by 13 percent on average, according to Flexera’s new “2022 State Of The Cloud” report.

Although organizations are spending more on the cloud than they budgeted, businesses are expecting to spend nearly 30 percent more in the cloud in 2022 compared with 2021.

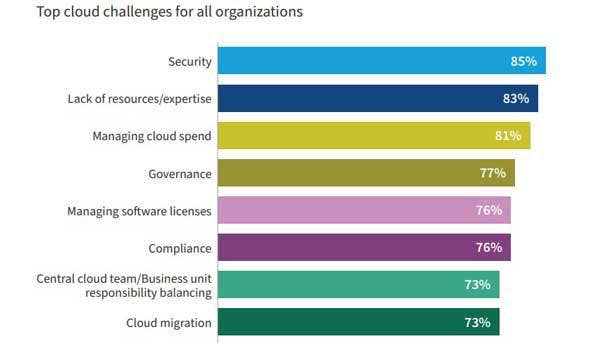

The top cloud challenges for businesses in today’s market is managing cloud spending, cybersecurity, and a lack of resources and expertise.

These are just a few of the results from Flexera’s new cloud report that surveyed over 750 cloud decision-makers with most respondents in director, manager, architect and executive roles.

Flexera’s new report sheds light on just how important cloud adoption and transformation are for most organizations as well as the biggest public, private and multi-cloud trends in the market today.

“To maintain their pace of digital transformation, organizations must have the cloud play a significant role in their strategy,” said Brian Adler, senior director of cloud market strategy at Flexera, in the report. “The cloud helps enterprises scale, be more agile, increase revenue and achieve business goals. We‘ve seen that cloud adoption has been expanding for the past few years, with a great acceleration by the pandemic. However, in the post-pandemic world that we’re shaping, we’re seeing new trends coming into focus.”

Given its central role in the future enterprise, research firm IDC forecasts total worldwide spending on cloud services, the hardware and software components underpinning the cloud supply chain, and the cloud services opportunities to surpass $1.3 trillion by 2025, with a compound annual growth rate of 16.9 percent.

[Related: AMD-Pensando Buy: From AWS Rivalry To Cisco, HPE Links—5 Things To Know ]

Flexera’s “2022 State Of The Cloud” report surveyed a panel of 753 technical and business professionals from around the world, with a focus in the U.S. and spanning a broad cross-section of organizations, who shared insight into their adoption of cloud infrastructure and services. Most respondents are cloud decision-makers and users from organizations ranging from 100 employees to more than 10,000 employees.

CRN breaks down eight of the biggest cloud trends based on data and figures from the 753 cloud decision-makers surveyed in Flexera’s new report.

Cloud Spending Overbudget By 13 Percent On Average

Organizations are overbudget for cloud spending by an average of 13 percent, while also expecting their cloud spending to increase by 29 percent in 2022.

This trend shows it’s more critical than ever to get a handle of cloud spending and cost optimization. However, the 13 percent of organizations that were overbudget on the cloud was down from 24 percent in Flexera’s 2021 report.

Jared Reimer, president of cloud MSP Cascadeo, said transitioning to become a cloud-first business shouldn’t be about pure IT budget cost savings, but about enabling businesses to do more with less.

“People who say, ‘We’re going to move to cloud because it’s going to save [us] a bunch of money’ are probably are wrong and haven’t done the math correctly,” said Reimer, whose company is one of Amazon Web Services’ top channel partners. “People who say, ‘We’re going to move to cloud because it’s strategic and it’s transformational, it’s going to unlock all sorts of new things that our customers are going to want or require of us in the future. This is a must win. It’s a C-level mandate,’ those are the customers that we love working with and are winning in the market against their competition.”

Wasted Cloud Spend

Wasted cloud spend is a major issue and becomes more critical as cloud costs continue to rise.

Respondents estimated that their companies waste 32 percent of cloud spend, up from 30 percent in 2021.

However, Flexera said spending is likely less efficient and likely even higher on average, as many organizations tend to underestimate their amount of waste.

Annual Public Cloud Spending: $2.4 Million To $6 Million Is Average

The increasing use of the public cloud is driving up cloud spending for organizations of all sizes, and public cloud spend is now a significant line item in IT budgets.

Approximately 37 percent of enterprises’ annual spending on the public cloud exceeded $12 million. In addition, approximately 80 percent of enterprise respondents—organizations with over 1,000 employees— spent more than $1.2 million per year on the public cloud.

Flexera said these enterprise figures are similar to 2021, when 36 percent of enterprises reported an annual spend of more than $12 million on the public cloud and 83 percent reported yearly spend of more than $1.2 million.

SMBs See Lower Cloud Bills

With SMBs running fewer and smaller workloads, the SMB market’s cloud bills are unsurprisingly lower.

Twenty-two percent of SMBs are spending less than $600,000 annually on the public cloud, compared with only 7 percent of enterprises. However, 53 percent of SMBs spend more than $1.2 million per year—up from 38 percent in 2021.

This shows that SMBs, on average, are spending more on the public cloud in 2022 compared with 2021.

Top Cloud Initiatives For 2022: Cost Savings, Workload Migrations, On-Premises To SaaS

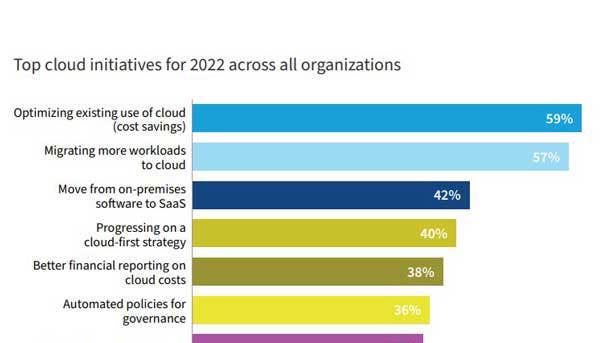

Cloud optimization usage is the top cloud initiative for the sixth year running, according to Flexera.

The discipline of financial operations is continuing to gain traction in large enterprises, which is why optimizing the existing use of the cloud is the top initiative across all organizations. Optimizing usage is a cost-control measure, with 59 percent of respondents saying it’s their No. 1 cloud initiative this year.

Ranking at No. 2 is migrating more workloads to the cloud, which can save money and add agility to businesses.

Approximately 57 percent of all organizations said workload cloud migration is a top initiative this year. As organizations move more workloads to the cloud, they can get rid of the technical debt associated with maintaining and operating their own data centers.

Ranking at No. 3 at 42 percent, respondents said moving from on-premises software to Software as a Service is a top priority in 2022. Moving to SaaS eliminates the resources required to manage similar on-premises software packages.

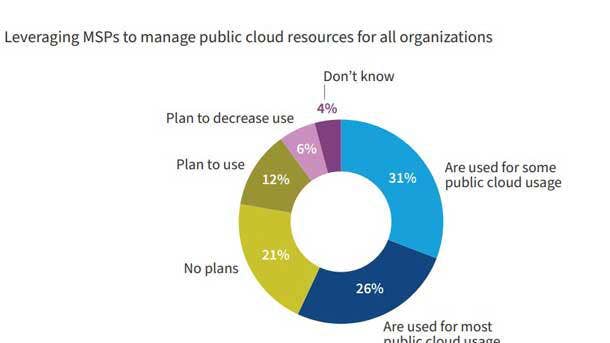

More Than 50 Percent Engage MSPs

Cloud MSPs are critical to helping organizations save public cloud costs, migrate workloads to the public cloud and transform customers’ entire IT environments if needed.

It is no surprise that more than half of all organizations are leveraging cloud MSPs to manage public cloud resources.

A total of 57 percent of all organizations are outsourcing at least some public cloud work, including 26 percent that engage with cloud MSPs for most of their public cloud use. In addition, 12 percent of businesses said they plan to use an MSP to manage their public cloud in 2022.

SMBs Less Likely To Use MSPs

Flexera’s report shows that SMBs are slightly less likely to use MSPs than enterprise organizations.

Approximately 57 percent of enterprises said they use MSPs, compared with 55 percent of SMBs.

In addition, 13 percent of enterprises plan to use MSPs in 2022, compared with 11 percent of SMBs. Also, 8 percent of SMBs said they plan to use MSPs less frequently, compared with 5 percent of enterprises.

Top Cloud Challenge: Security

When it comes to the top cloud challenges for organizations, security is top of mind. Approximately 85 percent of organizations said security is their top cloud challenge.

However, Bob Keblusek, CTO at Sentinel Technologies, a national cybersecurity solution provider, said questions around cloud security are beginning to fade away due to the heavy R&D that cloud market leaders have made in cybersecurity over the past few years.

Sentinel’s CTO said one of the top inhibitors in the past to cloud adoption was security. “But now,” he said, “some would argue there are so many security controls and capabilities when you move to cloud services from on-premises that we start to really enable customers to improve their security as they migrate to cloud.”

Cloud providers are also investing on acquiring top security vendors to boost security capabilities.

In March, Google unveiled its plan to spend $5.4 billion to acquire threat intelligence and cybersecurity services standout Mandiant to take Google Cloud’s security to the next level.

Following security challenges, lack of resources and expertise ranked No. 2 at 83 percent, followed by managing cloud spend at 81 percent and then cloud governance at 77 percent.

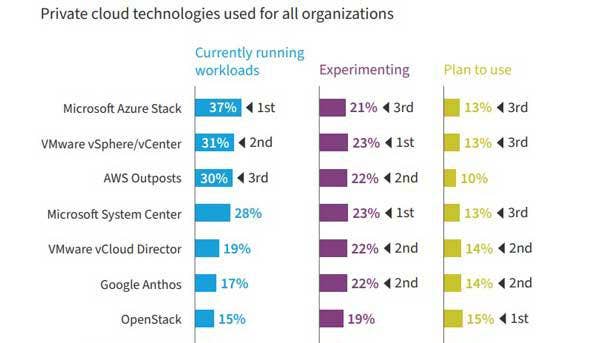

Private Cloud: Microsoft Azure Stack Surpasses VMware vSphere

With most businesses taking a hybrid cloud approach, the private cloud plays an important role.

Organizations currently running workloads on Microsoft Azure Stack increased slightly year over year and replaced VMware vSphere for the top spot, according to Flexera.

In private cloud adoption, 37 percent of respondents are currently running workloads on Microsoft Azure Stack, followed by VMware vSphere/vCenter at 31 percent, then AWS Outposts at 30 percent.

In terms of running workloads, VMware vSphere/vCenter and Microsoft System Center tied for first at 23 percent. Regarding what organizations plan to use in the future, 15 percent said OpenStack, followed closely by Google Anthos and VMware vCloud Director at 14 percent.

According to Flexera’s report, SMBs overall tend to use private cloud less than enterprises.

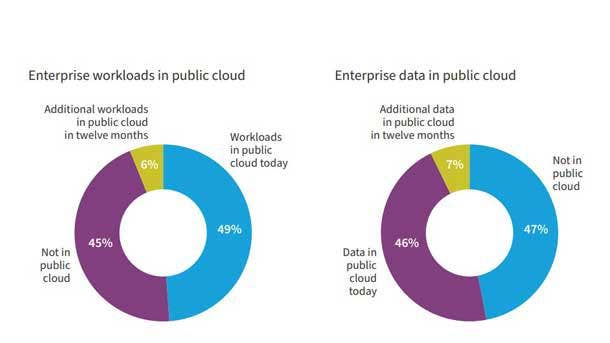

Nearly 50 Percent Of Enterprise Workloads And Data In A Public Cloud

Cloud-first policies and cloud migration are top of mind for IT leaders, particularly in enterprise environments. As a result, enterprises are rapidly increasing public cloud spending and workload volumes.

Enterprises are running 49 percent of workloads and storing 46 percent of data in a public cloud.

Enterprise respondents said they plan to increase workloads and data in the public cloud over the next 12 months by 6 percent and 7 percent, respectively.

As cloud estates expand, they need better governance controls to maintain visibility. With this expansion, more workloads with compliance mandates are entering the cloud, Flexera said.

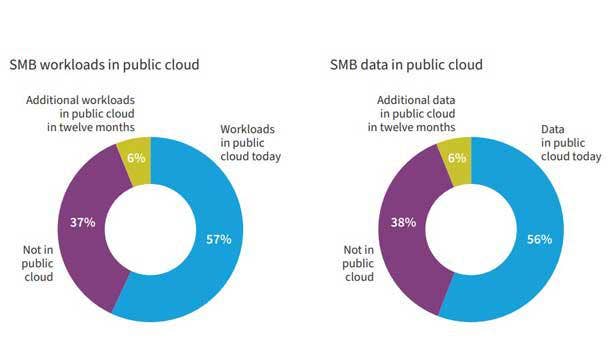

Almost Two-Thirds Of SMB Workloads Will Be In The Cloud

SMBs are moving quickly to the public cloud.

Nearly two-thirds—63 percent—of SMB workloads will reside in the public cloud within the next 12 months.

Approximately 62 percent of SMB data will live in a public cloud within the next 12 months.

In terms of the which public cloud providers SMBs are picking, AWS is leading the way.

Out of SMB respondents, 41 percent are currently running significant workloads on AWS, followed by 31 percent on Microsoft Azure and 21 percent on Google Cloud Platform.

Approximately 28 percent of SMBs are running some workloads on AWS and Azure, followed by 22 percent on Google Cloud Platform.

“The customers that are really winning with AWS are the ones who build high up the stack because you can just do so much more with less time, effort, energy, risk, security concerns, operations concerns—you can kind of push off a lot of the make-work and toil, onto the cloud platform,” said Cascadeo’s Reimer. “And that allows you to focus on what really matters—which is your product, your service, your feature, your customer—whatever it is that you’re going to do to make money and make the world a better place.”