Nutanix CEO On VMware Competition, Red Hat Wins And New Portfolio

Nutanix CEO Rajiv Ramaswami talks to CRN about the company’s new portfolio and core-base pricing, competition against VMware, growing market momentum with Red Hat and when Nutanix Clusters on Azure will be available.

Rajiv Ramaswami Talks Competition And Nutanix New Go-To-Market Strategy

Nutanix is looking to win more market share with the launch of the company’s new core-based pricing model and revamped portfolio that has simplified Nutanix’s 15 different products into just five offerings.

Nutanix CEO Rajiv Ramaswami said Nutanix’s new core-based pricing and metering will help channel partners win more hyperconverged infrastructure deals against the competition and drive storage sales.

“So what that does is basically—whether you’re using flash storage or whether you’re using just a standard disk—the software price is one of the same. Practically, what that means now, is that we are going to be much more attractive for all-flash configurations where before we had a premium. We would charge for that. Now we don’t,” said Ramaswami in an interview with CRN. “Therefore, it’s much more attractive from a competitive perspective for all-flash configurations which more and more customers are migrating to these days.”

The San Jose, Calif.-based hyperconverged infrastructure software superstar and rising hybrid cloud player this week reported second fiscal quarter 2022 revenue of $413 million, an increase of nearly 20 percent year over year. Additionally, Nutanix generate record annual contact value (ACV) billing of $218 million, up 37 percent year over year, while also posting a positive free cash flow for the first time in over three years.

“We’ve seen a more rapid closure for some deals utilizing the new simplified pricing and packaging,” said Ramaswami. “We expect to see more high velocity transactions for both our own sales reps, as well as with our partners.”

In an interview with CRN, Ramaswami talks about market momentum with Red Hat, competition against VMware, when the new Nutanix Clusters on Microsoft Azure will be available and how channel partners can drive sales with Nutanix’s new portfolio.

How will the new core-based pricing and new portfolio will help Nutanix get an advantage over VMware?

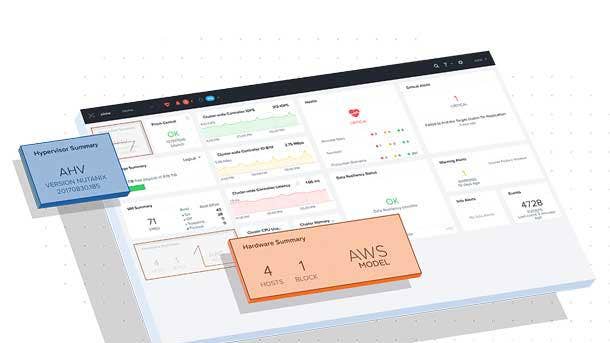

Fundamentally, we are focused on creating a platform that is differentiated in terms of how we handle data—providing simplicity to our customers, providing the flexibility of choice at every level of the stack whether it’s hardware, whether it’s hypervisor, whether it’s cloud native stack, whether it’s cloud of choice, and whether it’s the subscription term, full license portability, etc. So that fundamentally doesn’t change for us as an advantage.

With the new portfolio that we’ve launched, it just makes it easier. All of this becomes easier. It becomes easier for a customer to go get our products for the use case they want, get it deploy easily with our solutions and validated designs, as well as our deployment guides.

And it makes it easier for us and our partners to get the sale done quicker as well. It just aids in us being able to do more with our partners and customers quicker.

How does the core-based pricing model help partners win more in the market?

We simplified it to having all pricing for the Nutanix Cloud Infrastructure now just based on per-core pricing. We no longer have storage-based pricing with it.

So what that does is basically—whether you’re using flash storage or whether you’re using just a standard disk—the software price is one of the same. Practically, what that means now, is that we are going to be much more attractive for all-flash configurations where before we had a premium. We would charge for that. Now we don’t.

Therefore, it’s much more attractive from a competitive perspective for all-flash configurations which more and more customers are migrating to these days.

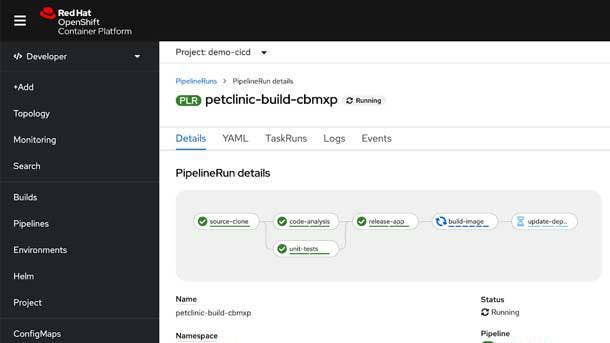

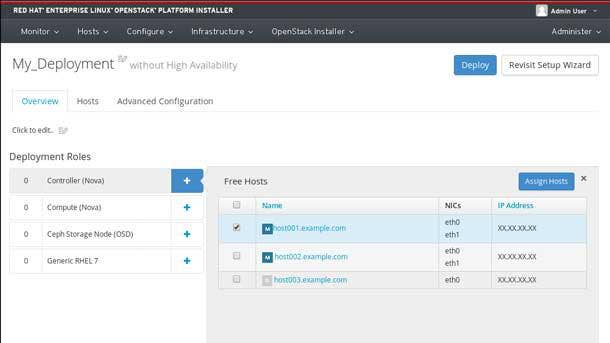

How is your new Red Hat partnership helping you win over VMware?

Our customer base is running both traditional workloads on virtual machines and they’re also looking at their modern application development being done on container-based platforms—of which Red Hat with OpenShift has the lead platform in the market. So it’s a logical thing for us to make one-plus-one greater than two.

Because those OpenShift container-based workloads have to run on a platform, for us, the ability to run that on a Nutanix platform allows us to become very relevant for both virtual machine-based workloads and for container-based workloads.

If you look at the total stack: we provide the infrastructure as-a-service stack, Red Hat provides the platform as-a-service stack. So those two put together allows a customer to run the entire stack for running both modern and traditional applications. This is why there’s a lot of interest in us going together to go win in the market together.

Where are you seeing Nutanix-Red Hat market traction?

We are engaged with the Red Hat team in a number of accounts. They largely go into two categories.

One, is simply Red Hat Enterprise Linux is fully certified [on Nutanix]. So our entire stack is now fully certified for Red Hat Enterprise Linux and OpenShift. So just off the bat, all the mission critical applications that are running on Red Hat, customers are going to be very comfortable now running that on a Nutanix platform because it’s fully certified.

The second leg of the partnership is around OpenShift and landing OpenShift workloads on our platform.

[For example] there was an European-based energy services provider joint customer who shifted their container-base big data workloads that were running on OpenShift on a competing HCI solution to the Nutanix Cloud platform, including our AHV hypervisor. We also saw an American-based retailer deploy their business-critical workloads on Red Hat Enterprise Linux, or RHEL, running on the Nutanix Cloud platform.

In both of these wins, our joint customers were able to see improved performance and meaningful cost savings by running on our AHV Hypervisor, assured by the recent certification of both OpenShift and RHEL on AHV.

So that combination of OpenShift running on top of Nutanix Cloud platform is the other second leg of the stool for us.

What is the timeframe for when Nutanix Cluster on Microsoft Azure will become generally available for partners to sell?

We, of course, want to get this to general availability as quickly as we can. I don’t have a date for us to tell you yet. But it’s certainly going to be this year.

We are now in what we call private preview with Nutanix NC2, Nutanix Clusters on Azure. We’re seeing certainly a lot of interest from customers and there’s a set of customers waiting. We certainly want to enable all our partners to be able to go sell that in the market.

What I would say right now, by the way, is that we’re seeing good traction on Nutanix Clusters on AWS. We’re seeing many customers go into production for the three use cases: disaster recovery, cloud migration and elastic capacity expansion. So I would urge our partners right now to also focus on selling our Nutanix Clusters on AWS solution.

How can channel partners leverage your new portfolio to drive sales? How big of an impact is this for partners?

With this new Nutanix portfolio, it’s much more aligned to how customers are likely to consume. We’ve already seen that from some of the initial feedback that we’re getting with this new portfolio.

So from our partners perspective, what that means is, they can go into a customer and say, ‘Customer, are you interested in building a cloud? Here’s the Nutanix Cloud Infrastructure. Do you want to manage the cloud? Well, here’s the Nutanix Cloud Manager. Do you want to store all your unstructured data? Here’s Nutanix Unified Storage. Do you want to run your databases? We can help you run your databases with Nutanix Database Service.’

So we are really lining up to these broad use cases. Then of course, within those we have tiered offerings. It should be easier and it should be a higher velocity motion for our partners now.

We are enabling our partners to really take this new portfolio to market. [We’re] delivering what we call channel autonomy, which is enabling our channel partners to become much more independent and be able to sell independently. That means being trained on the new portfolio, which we are doing now, being able to have all the appropriate sizing tools so that they can go size and go court customers independently.

They can run these deals largely independently without a lot of help from us. We’re always going to be there, of course, help our channel partners. We’re now squarely focusing those enablement efforts now with this new portfolio.

What is the Nutanix hiring strategy for 2022?

We’re continuously hiring across all functions: across R&D, across sales, etc. It’s sort of one of the most important things for tech companies including Nutanix.

But even before hiring, we’re focused on retaining our employees and top talent continues to be a priority. We grew our total headcount this last quarter.

We’re also bringing in headcount from public cloud players, including engineering talent, to our experience with delivering solutions as-a-service. We’re also bringing in sales talent that has experience with subscription and SaaS selling.

Finally, it’s also an opportunity for us to become more diverse as a company in terms of hiring talent wherever they are, especially since now we’re all in our distributed work environment. We continue to do that and are pursuing that aggressively. Finally, all of this happens because our employee base and prospective employees are all excited by the vision of Nutanix being a hybrid, multi-cloud company with a unique value proposition to the market.

How do you feel Nutanix did in your second fiscal quarter?

We outperform, again, this quarter. We exceeded all of our guided metrics. We are building momentum in renewals. Our subscription model is coming along. ACV building grew 37 percent year over year, our highest growth rate in three years. Our revenue growth was 19 percent year over year.

By the way, we are seeing this kind of growth even when some of our competitors have announced less-stellar numbers when it comes to this portion of that business on the HCI piece.

We continue to be well on track to achieving a target of sustainable, positive free cash flow this calendar year. We continue to make progress against our vision, with our new product portfolio which we launched globally and simplified.

Finally, we continue to also see our hybrid multi cloud vision resonating with our customers. This is the notion that cloud is an operating model, not a destination. We have the solutions to make this journey to hybrid cloud less complex.

What’s your message to the partner community?

Get familiar with the new portfolio. Get enabled and trained on being able to take that to market independently as much as possible. Build a practice and take this to market. It will help our partners be successful. And frankly, when partners are successful, we will be successful. So our success at Nutanix is mutually tied together. So let’s go with together.