SADA CEO Tony Safoian: How Google Cloud Is Besting AWS

SADA CEO Tony Safoian talks to CRN about the company’s new $2.5 billion Google Cloud partnership, besting cloud competitor AWS and its push to become a more global channel partner.

SADA’s Tony Safoian On Google Cloud Vs. AWS

Google Cloud channel partner superstar SADA Systems is winning over more AWS customers due to Google Cloud’s more resilient network, big data capabilities and “exceptionally strong security story,” which is becoming the gold standard in cloud security, said SADA President and CEO Tony Safoian.

“We’re winning from a significant migration of existing data centers, and we’re winning from other clouds,” said Safoian, who has over two decades of top-notch channel and cloud experience.

SADA, a Google Cloud Premier Partner and member of the 2022 Elite 150, part of CRN’s Managed Service Provider 500 list, is betting so heavily that Google Cloud will grow its cloud market share and take SADA to new heights that the Los Angeles-based company has formed a new partnership agreement with Google with the goal of driving customers to $2.5 billion worth of Google Cloud consumption over the next three years.

The new agreement has SADA and Google Cloud teaming up to roll out additional offerings and services together to drive billions of dollars in sales in the coming years.

In 2020, the two teamed up for a similar agreement with a three-year goal of $500 million in driving adoption of GCP and other technologies. SADA met that goal in just over two years.

“The fact that we surpassed the $500 million mark in just two years and a quarter versus the three years that we had to achieve that is a great sign,” said Safoian. “It’s a great sign about the demand for GCP, and it’s a great indicator of our ability in this company to drive the value of GCP inside of our customers. It’s very straightforward: If we don’t drive value, they don’t consume. If we do drive value, they transform, their business grows, and they consume more. So it’s very honest from that standpoint, and I just love that about this business.”

In an interview with CRN, SADA’s leader talks about Google Cloud compared with AWS, Google security’s push and the solution provider’s strategy that’s elevating SADA into a global player.

You mentioned customers switching from AWS to Google Cloud. Why are you seeing AWS customers switching to Google Cloud?

There are two or three areas where Google is just better.

Absolutely the fastest, most globally available, most resilient network lives in Google Cloud. That’s just by virtue of their fiber investments. They own all of this fiber. It’s global, low latency—just an incredible network. So if you’re doing anything that requires that level of performance, like so many of our customers are, that’s absolutely the case.

Two is data. Data, whether it’s BigQuery or even some of the other solutions that run on GCP that are data-heavy—they have, by far, the best platform for the massive amounts of data. Whether it’s Google Cloud data lakes or whatever that customers are creating to be able to then gain insights from their data and build ML [machine learning] and AI [artificial intelligence] models on top and provide more predictive analytics and provide better services to their customers and predict their own businesses better—Google has the best data story, period.

Of course, then No. 3 is security. Google is the most secure cloud for sure. They invest tons and tons in making sure that’s the case with the tooling they provide.

Can you double down on why SADA is seeing AWS customers turn to Google Cloud for security reasons?

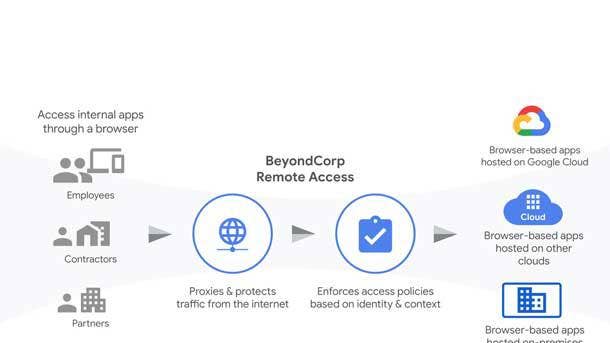

So Google also owns, and we sell, BeyondCorp zero-trust enterprise security and Chronicle for threat detection and other additions to the security suite. So they have an exceptionally strong security story.

But there’s also sort of a generational shift that’s happening. Many of the customers who were relatively cloud-native but started 10 or 15 years ago by default on AWS. Why? Because the other hyperscalers just weren’t there, right? AWS was first to market. So they created these architectures that were kind of the best available at the time that were still, by today’s standards, quite archaic in design. They started to feel and operate much like a traditional data center. They weren’t getting all the benefits of new architecture.

They weren’t getting all new benefits of switching from compute and storage to platforms like BigQuery. BigQuery is going to perform better than any other database hosted on an AWS machine, you know what I mean?

So therefore, it’s an opportunity to rethink the entire architectural strategy in these digital companies—that Google journey gives them opportunity to do that. That’s a driver for a lot of these migrations. Just to completely rearchitect using the best of, not just the network and infrastructure capabilities of Google Cloud, but platform which, of course, is always cheaper and faster than then doing it in virtual machines.

Google is set to acquire security standout Mandiant for $5.4 billion. How bullish are you on Google Cloud security and where are you seeing growth?

Over the last several years, we’ve seen this massive increase in all sorts of attacks: phishing attacks, ransomware, and that’s even before the current instability with the geopolitical situation. With all the regulatory compliance requirements of public companies, also in certain verticals, also with the reputational risk of a major breach—no organization can afford being sloppy with security.

Actually, this is also why we’re seeing tremendous growth in, for example, Google Workspace and Chrome. That’s part of the Google Cloud story. I mean, we spend so much time talking about GCP because it’s the biggest addressable market, but all of Google Cloud’s posture is so focused on security.

In a customer’s environment because the endpoints are often the weakest points, Workspace on a Chrome device is probably the most secure endpoint posture possible. So their whole story has been heavy on security. No organization can afford a breach.

If you think about the pedigree of Google itself, is there a bigger target in the world for incessant attempts at penetration and compromise in Google itself? All of Google’s properties? The nine apps used by over a billion people?

They just come from this hardened posture of having the best security folks on the planet working for them, securing the core infrastructure of Alphabet itself, which is precisely what GCP and Google Cloud are built off of. So it’s very natural for them to understand the importance of security. Mandiant will just further help that.

How will Mandiant help Google?

Mandiant gives them even a broader footprint and set of capabilities with regards to SOC and other services, like actual services around cloud technology. We started a security practice of our own a couple of years ago, [which] was born out of our infrastructure practice. So [we’re] getting very prescriptive with our customers around the best security posture with GCP.

People believe it’s automatically more secure. Well, it’s not, if you leave open buckets and your password is ‘admin/admin,’ and you haven’t done those things. It’s not automatic. There’s a lot of thoughtful planning and making sure everything that our customers are doing in GCP itself is secure by design with privilege principles, all sorts of monitoring and logging and reporting, using BeyondCorp, and using even things like reCAPTCHA, which is another Google product, or using Chronicle for monitoring and logging.

Google intends to continue to have the best security story in the business. Because it’s not just the credibility of companies themselves, but the credibility of the hyperscalers. If the customers believe that the hyperscalers aren’t doing these things and aren’t providing the tooling and the guidance on this, then I think the credibility of the cloud itself is at risk.

So Google intends to be No. 1 in security.

How did you get to $500 million of Google Cloud in just over two years from 2020 to 2022?

We win hundreds of new customers every year. Last year was probably around 400 new customers. Many of them, this is their first entry into using any of the Google Enterprise, Google Cloud services or their first time using GCP. So we’re seeing significant migration of existing data centers, often also from other clouds.

For example, [a recent large] deal at the end of last year—was migration from AWS. So we’re winning from a significant migration of existing data centers, and we’re winning from other clouds

The other vector is just how much our cohort of customers are growing. We serve big parts of the traditional enterprise, the Fortune 500 and so on, but we also serve the cohort of the digital companies that are born every year. MadHive is a great public example and there are others where these businesses that are built entirely on Google Cloud are growing themselves. Their revenues are growing. They’re winning a bunch of customers. That of course pulls GCP consumption up as Quantum Metric and MadHive and HYCU—these digital companies themselves—are growing. That pulls the GCP consumption up with us. So I think it was a combination of exceptional customer acquisition, lots of new customers every year and tremendous growth in our own customer base.

What is one key channel market differentiation that SADA has that is winning over customers?

We do lots of things that traditional services companies of the past did not do. We deploy customer experience teams to every customer to make sure all the technical barriers over time on a continuous basis are alleviated for them.

We are clear about the road map of how the products are going to change and how they can take advantage of it. We provide enterprise support, customer experience managers, technical account managers—every one of our customers gets that level of love and care. Then we make sure that their journey as they grow, and their investment in Google Cloud, continues to produce value for them.

So this is just a very different business versus the old days of packaged software where customers used to essentially pay in advance for something and then hope that it produces value.

For us, it only produces value to the degree that we are working with our customers on a daily basis to make sure it does. We’ve been doing that really well.

How confident are you in SADA’s new $2.5 billion Google Cloud goal?

Our experience and gaining confidence from that first $500 million commit, and seeing our own pipeline and our own trajectory, and our global expansion plans, and SaaS alliances—all these things are providing a tremendous amount of both confidence and tailwinds.

We felt that we were in a position to make a commitment now that is five times larger than the original one because we have a very clear line of sight into the next three years and nine months. So we have clear line of sight. We know we’re going get there. It’s just very clear for us.

Talk about SADA’s growth plans and your future with Google Cloud.

It’s certainly in all of our ambitions and part of the plan, and why this $2.5 billion new commitment also made sense—we’re being pulled into markets outside North America.

We made this acquisition of a Google partner in India [ByteWave]; we opened an office in Armenia; we just made our first hire in the U.K., and we have a pipeline of talent there. We’re being asked to enter APAC, Japan, Latin America—both by our customers who are multinational but also by Google.

I’m just very excited about the potential of the global markets. I feel like what we’ve done here in North America is exemplary of that because even in North America, we’ve expanded from the Bay Area where all the demand was many, many years ago and where we cut our teeth, then took that stuff to New York, and then LA and to Canada.

Three years ago, we had three people in Canada. Now we have 120. Now, with a very similar approach, we are going global.

I feel like our capabilities and our set of services and Google Cloud are in incredible demand globally. The number of capable partners with our competencies is quite limited. So I feel like we’re going be welcomed with open arms in all these new markets. And I’m really excited about the global potential.