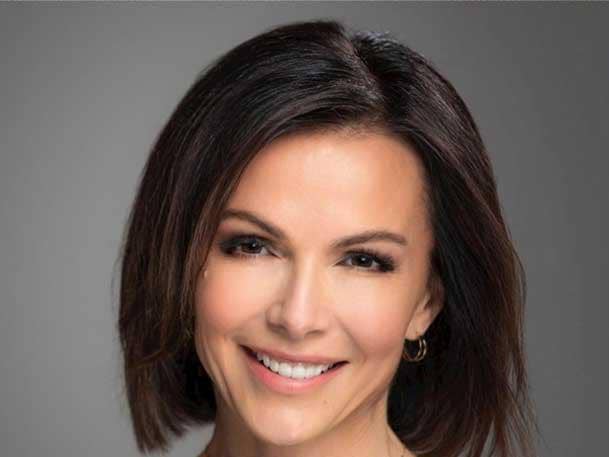

VMware’s Hogan On Cloud Marketplace ‘Disruption’ And Dell Partnership

VMware’s worldwide channel chief, Sandy Hogan, talks with CRN about public cloud and distributor marketplaces, her channel strategy in 2022 and VMware’s channel partnership with Dell Technologies now that VMware is independent.

Sandy Hogan: ‘Marketplaces Are Clearly A Disruptive Force’

There’s no doubt that public cloud marketplaces from Amazon Web Services, Microsoft and Google Cloud are disrupting the traditional channel partner resell motion. However, VMware’s worldwide channel leader, Sandy Hogan, said there are many “unique opportunities” for partners to take advantage of these cloud marketplaces.

“Without question, marketplaces are clearly a disruptive force, not just for VMware but for all of us. We are all on this journey together,” said Hogan, VMware’s senior vice president of the worldwide partner and commercial organization, in an interview with CRN. “Frankly, with any kind of disruption like that, we believe it leads to significant opportunity.”

Hogan also explained how focusing on customer success will be key for channel partner profitability compared with traditional resell transactions.

“In the future, most of the profitability for a partner or for a business will actually come from how you retain and grow your customer, not how you transact with your customer. So when you think about that, that whole skill set is what we want to help accelerate in the market,” said Hogan. “We’re seeing our partners having two times to three times the profitability because that’s where it’s going to come from.”

Hogan talks with CRN about the partner opportunities in public cloud and distributor marketplaces, her channel strategy in 2022, and VMware’s channel synergy vision with Dell Technologies now that VMware is an independent company.

VMware’s current marketplace agreements with AWS, Google and Microsoft allow a customer to choose that marketplace option as a way to procure your software. When this happens, the margin the channel receives for uncovering the opportunity and driving the deal—even when registered and approved by VMware—can be smaller than what they had forecast when transacting the deal directly. What are your plans in FY23 to help your channel on this?

Without question, marketplaces are clearly a disruptive force, not just for VMware, but for all of us. We are all on this journey together. Frankly, with any kind of disruption like that, we believe it leads to significant opportunity. Here’s what I would outline for that.

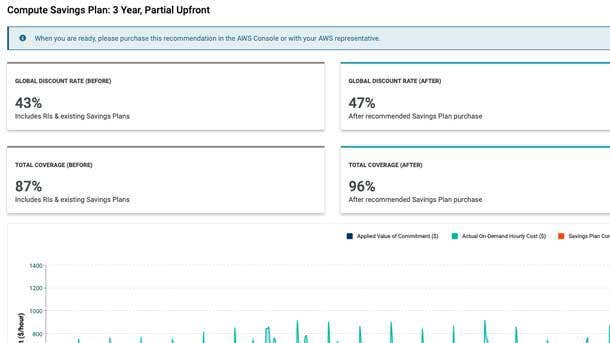

First, we’ve created a way particularly with the hyperscaler marketplaces [to transact]. I don’t even know some of the numbers that are thrown out there, but hundreds of billions of dollars are unconsumed from the hyperscalers. Marketplaces are a way for customers to earn that customer commitment.

Marketplaces, on average, close 30 percent faster than a traditional transaction. So when you think about time to value, if a partner is engaged in that, they get faster through the sales cycle. And we’re partnering with the hyperscalers so partners are not excluded from participating in marketplaces. So they can leverage that. It does require the need for partners to really differentiate their services so that they can bring that faster time to value.

What are some opportunities for partners in public cloud marketplaces?

Here are some unique opportunities: It gives partners access to the large consumption commitments that they traditionally didn’t have. So it gives them visibility to engage with customers in unique ways that deliver that value.

It also provides an opportunity for partners to create more managed services offerings because when they create those offerings, they can actually publish them on the marketplaces. So it creates a new revenue stream for them and a differentiating IP and value.

Now it doesn’t change the resell disruption. You see everywhere that the resale motion, by itself, is not going to be the same. I actually think this year is going to be one of the most disruptive years in that resell motion, which is why we’re putting so much emphasis in the other areas for partners to be profitable.

What about distributor marketplaces?

Aside from the hyperscaler marketplaces, there’s a big disruption with the distributors. The distributors are making significant investments in creating their marketplaces.

I believe this is another unique area for partners because the distributors will be able to help aggregate and bring solution capability together across multiple vendors. They’ll be able to provide the back-end office support and systems that will enable partners to transact more quickly and then bring that ultimate value across the life cycle, which is truly what differentiates them to the customer.

With VMware now an independent company from Dell Technologies, should VMware partners expect any less synergies from Dell on the channel partner program side? Can you talk about Dell and VMware partner program synergies this year?

Regardless of pre- and post-spin-off, my objective and our team’s objective is to create a partner ecosystem that is robust, interconnected and gives every partner the opportunity to develop and extend their capabilities.

With that said, Dell is going to continue to be a very strategic partner for us. And we will also grow that strategic ecosystem because it’s also opening up the opportunity for new conversations. But it’s really more of an answer of ‘and’ because we plan to continue that partnership. This ecosystem is now incredibly complex.

So it’s not just about Dell and VMware. It’s about Dell, VMware and multiple partners, who are going to play various roles throughout that life cycle.

Are there any big changes to VMware’s fiscal year 2023 partner program?

The first is it’s no longer around a partner type, it’s the business model. Partners are adopting more and more business models. We have over half of our partner population that executes two or more different business models—whether they’re a reseller, they are an adviser integrator, or they’re an operator where they’re doing the fully managed offerings for a solution builder.

So the fundamental shift in direction for us will be around aligning to partner business models, meaning, the more business models a partner has, they will have ease and flexibility in being able to build new practices, very quickly be able to see and apply that to their tiering status, and be able to get more enablement across all of those.

So we’re moving from bucket-sizing partners in a certain type to really evolving them and enabling them to create more competencies. It’s all for them around accelerating their ability to build unique IP and services and differentiation that will drive more profitability for them.

A big focus for VMware this year is pushing partners to double down on advanced services. What are some good examples of advanced services you would recommend?

We have many different examples. For example, we have a partner who built a managed services offering around financial ops with [VMware by] CloudHealth and is building a cost management service through the on-boarding and governance tooling.

We have a partner who built a services offering around a fully managed VMware VDI [virtual desktop infrastructure] deployment and building off that.

Cloud migration is still a big path that customers want. Everything’s been around cloud and now customers have gone to public cloud. Now it’s about getting cloud smart. So the partners are really able to define their niche where they can bring that differentiated value.

So I’m cautious in picking just a couple. The whole point of this is knowing where the customers are and what they’re trying to solve in their multi-cloud, digital transformation journey—that there’s no one answer. I’m not gearing toward one solution or the other because there’s really so many that can be provided based on the customer in their journey.

How do you define VMware’s Customer Success approach regarding the channel and customers?

There’s been the legacy way of doing it, which is people who have traditionally provided technical expertise and support. People have [also] related customer success to the SaaS subscription motion because now you have to constantly prove value to the customer in order to retain the business.

We view customer success—whether it’s SaaS subscription, licensing, the whole experience—it’s about having expertise. It’s about having customer telemetry to know what technology they’re using, what problem they’re trying to solve, and working with the customer to make sure they’re always providing that level of expertise to help the customer utilize and optimize the technology, solve for the business outcomes, etc. That’s a whole new skill set partners are building. Some of them are experts at it. Many of them are just building out these new practices.

What we’ve done as one of the first steps is we’ve launched a Customer Success Competency. So that is around enabling and also eventually incentivizing our customers to build that practice capability.

In the future, most of the profitability for a partner or for a business will actually come from how you retain and grow your customer, not how you transact with your customer. So when you think about that, that whole skill set is what we want to help accelerate in the market. We’re seeing our partners having two times to three times the profitability because that’s where it’s going to come from. And most importantly, it creates the customer satisfaction and value that they’re seeking.

What are three main focus areas in VMware’s channel strategy for fiscal year 2023?

There’s a magnitude of disruption that’s happening in the industry. We have introduced this notion of the direction that VMware is heading to support the multi-cloud vision that [VMware CEO] Raghu Raghuram (pictured) has really laid out. In the end, what we’re seeing is that this customer-for-life motion is real, it’s tangible, it’s around—while the transact is important— it’s around influence, deploy and consume. From a customer standpoint, time to value, and value delivered, becomes one of the most critical differentiators for our partners. Customers are looking for that unique differentiation.

There are three areas fundamental to that that we’re focused on.

Providing an unrivaled partner experience is at the forefront for everything for us. That’s the core piece to partner profitability: efficiency, automation and effectiveness. VMware has been really middle of the road there in the past, and we’ve had challenges and we’re bringing it up a notch and really taking it to an unrivaled experience. It’s the area that we’ve probably put the most amount of dollars to because the more we create that experience, the more that frees up the partners to drive more of the profitability initiatives.

The second is around delivering customer outcomes. That’s everything from how we co-create solutions, it’s the launching of the Customer Success Competency that is now built within the portfolio, and the partner-to-partner ecosystem that we’re really driving.

Then the last piece is the VMware profitability journey is actually being redefined by our partners. Because they’re creating more of these complex services, we’re actually seeing our best partners are two times to three times more profitable when they have invested in these types of new services offerings, and in particular, around customer success. We’re looking at creating new ways for our partners to develop MSP offerings and being able to publish those offerings in marketplaces so we now create that multiplier effect.

So everything around 2022 is going to be around executing against all of those capabilities this year.