10 Big Moves By Intel CEO Pat Gelsinger In His First Year

A new hybrid manufacturing strategy, a multibillion-dollar semiconductor acquisition deal, a reorganization of business units and a “software-first” approach. These and other big moves were made by Pat Gelsinger in his first year as Intel’s CEO to restore the company’s leadership position.

From IDM 2.0 To Intel’s $5.4B Tower Semiconductor Deal

Tuesday last week marked Pat Gelsinger’s one-year anniversary as Intel’s CEO, and he decided to celebrate the occasion by announcing the company’s intent to acquire an Israeli chip manufacturer, a move that will “significantly” advance the hybrid manufacturing strategy he declared early in his tenure.

Intel’s deal to acquire Tower Semiconductor for $5.4 billion is but one of several big moves Gelsinger has made since he started his role as Intel’s CEO on Feb. 15, 2021. And all the developments have been in the name of restoring Intel’s reputation as the “unquestioned leader” after falling behind competitors — both fabless chipmakers like AMD and chip foundries like TSMC – for years.

[Related: 6 Big Announcements At Intel Investor Day 2022: GPUs, CPUs And More]

The efforts of Gelsinger in his first year as CEO culminated with a presentation at the Intel Investor Day 2022 meeting last week, where he and other executives detailed a four-year comeback plan that would require a large amount of spending to make Intel the leader once again. While Gelsinger’s return and his comeback plan have brought back a sense of optimism for many Intel employees, investors were skeptical of the plan and sent Intel’s stock price down more than 5 percent last Thursday.

“The Intel turnaround train is leaving the station, and I hope you all get on board. It’s an ambitious goal. But I am confident Intel’s best days are in front of us,” Gelsinger said in his presentation.

What follows are 10 big moves made by Gelsinger in his first year as CEO, which includes the Tower Semiconductor deal, the creation of Intel Foundry Services, several new leadership appointments, a reorganization of the company’s business units and his Mobileye spinoff plan, among other things.

IDM 2.0 Strategy

A key tenet of Gelsinger’s comeback plan for Intel is his IDM 2.0 strategy, an evolution of the company’s traditional integrated device manufacturing model that was announced in March 2021, shortly after Gelsinger became CEO. Instead of just manufacturing chips that Intel designs, Intel will now also manufacture chips designed by other companies through the new Intel Foundry Services business that Gelsinger created as part of the IDM 2.0 strategy. But in order to ensure there is enough manufacturing capacity for Intel’s products and products made by foundry customers, Gelsinger is planning a major manufacturing expansion through a combination of new plants and plant upgrades. And for the areas where Intel’s manufacturing capabilities aren’t up to snuff, the company will rely on external foundries like TSMC to make some of Intel’s products, another key aspect of IDM 2.0.

Manufacturing Expansion

As part of his IDM 2.0 strategy, Gelsinger is doubling down on Intel’s manufacturing heritage with new fabs in Arizona, Ohio and in Europe. The buildout plans are meant to make way for a projected increase in demand for Intel’s own products, and Gelsinger is hoping the new fabs will also be busy making chips designed by other companies through Intel Foundry Services. With the expansion, Gelsinger wants not only to increase overall chip manufacturing capacity so that future shortages can be avoided, but he also wants to ensure that capacity is more geographically distributed so that companies aren’t overly reliant on chip foundries in Asia. This all began with a $20 billion plan Gelsinger announced in March 2021 to build two new fabs on the company’s Arizona manufacturing campus. He then followed that up with an announcement in January 2022 that Intel will invest at least $20 billion into a “mega-site” for chip factories in Ohio that he said will eventually become “one of the largest semiconductor manufacturing sites in the world.” He is also expected to announce a new manufacturing site in Europe.

Intel’s $5.4B Tower Semiconductor Deal

On his first-year anniversary as Intel’s CEO, Gelsinger announced the company’s plan to acquire Israeli chipmaker Tower Semiconductor for $5.4 billion, which he said would “significantly” advance its plan to manufacture chips for other companies. A key aspect of the deal is Tower’s network of chip manufacturing plants, which are distributed across Israel, Italy, United States and Japan. Gelsinger said Tower’s network of fabs will aid Intel’s goal of becoming a major foundry provider through Intel Foundry Services. Another area where Intel Foundry Services will get a boost is through Tower’s portfolio of specialty technologies — which includes those for radio frequency, power, silicon-germanium and industrial sensors — as well as its “extensive IP” and electronic design automation partnerships.

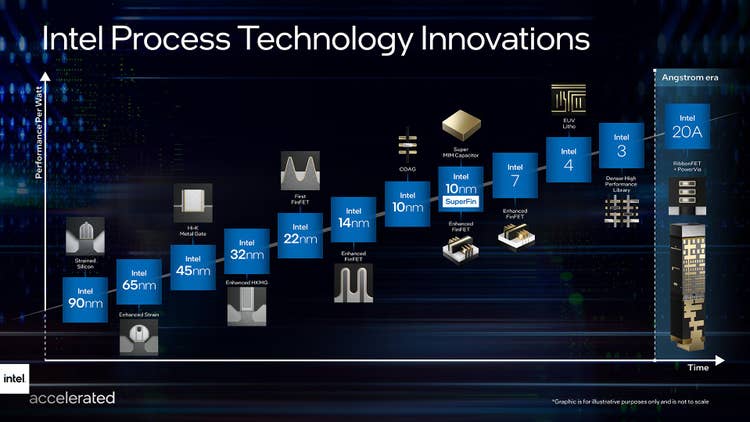

Intel Node Renaming

As part of Gelsinger’s comeback plan, Intel changed the node naming structure for the chipmaker’s manufacturing process roadmap in July 2021 to reframe its manufacturing capabilities against competing chip foundries. The change resulted in Intel renaming its 10-nanometer Enhanced SuperFin process, which is used for the Alder Lake client CPUs that launched last fall, to Intel 7, and its 7nm process, which will be used for processors that ship in 2023, to Intel 4. Those nodes will be followed by Intel 3, due for production in the second half of 2023; Intel 20A, due in 2024; and Intel 18A, due in early 2025. Intel said it made the move to make it easier for customers to understand how the company compares to competing chip manufacturers like TSMC because the “traditional nanometer-based process node naming stopped matching the actual gate-length metric in 1997.” With the new process roadmap, Gelsinger declared that Intel would return to “process performance leadership” in 2025, which is especially important for the new Intel Foundry Services business.

Data Platform Group Reorganization

Early in the summer of 2021, Gelsinger announced a restructuring of Intel’s Data Platform Group, which housed the chipmaker’s businesses for data center, edge and network chips. The reorganization split the group into two business units: the Datacenter and AI Group, which includes the company’s Xeon, FPGA, Optane memory and Habana Labs AI products; and the Network and Edge Group, which brought together products from the Network Platforms Group, Internet of Things Group and Connectivity Group. In conjunction with the reorganization, Gelsinger ousted the leader of the of the Data Platform Group, Navin Shenoy, and named longtime Intel executive Sandra Rivera to lead the Datacenter and AI Group. The Network and Edge Group, on the other hand, would be led by McKeown, a former part-time Intel fellow and co-founder of Barefoot Networks, which Intel acquired in 2019. The restructuring of the Data Platform Group was accompanied by the creation of the Software and Advanced Technology Group, which Gelsinger appointed former VMware CTO Greg Lavender (pictured) to lead, and the Accelerated Computing Systems and Graphics Group, which is being led by chip architect Raja Koduri. Intel revealed in late January 2022 that it would begin reporting revenue for the Datacenter and AI Group, the Network and Edge Group, the Accelerated Computing Systems in financial results for fiscal year 2022.

New Executive Leadership Appointments

Gelsinger’s reorganization of the Data Platform Group isn’t the only time the CEO has made his own appointments to Intel’s executive leadership team. Even before Gelsinger started his CEO job in February 2021, the news of his return helped convince Intel veteran engineer Sunil Shenoy (pictured) to rejoin the company as senior vice president and general manager of the Design Engineering Group. Several months later, in July 2021, another Intel veteran engineer, Shlomit Weiss, returned to lead the Design Engineering Group alongside Shenoy. Shortly after Gelsinger became CEO, he named Randhir Thakur as president of the new Intel Foundry Services business.

Perhaps the biggest sign that Intel’s executive leadership team has changed since Gelsinger’s return as CEO is the fact that the company’s six most highly compensated executives from 2020 have left or are in the process of leaving (not counting former CEO Bob Swan or former engineering head Murthy Renduchintala, whose departures predated Gelsinger’s return). This includes not only Navin Shenoy of the Data Platform Group but also CFO George Davis, who is retiring after Gelsinger named his successor, David Zinsner, in January. Steven R. Rodgers, Intel’s general counsel, is also retiring, though Gelsinger hasn’t named a permanent successor yet. Gelsinger did, however, name Michelle Johnston Holthaus, as the successor to Gregory Bryant, the former head of Intel’s Client Computing Group who left Intel in January for a new opportunity. Most recently, Gelsinger named longtime HP Inc. executive Christoph Schell as chief commercial officer and head of Intel’s Sales, Marketing and Communications Group.

Mobileye IPO Spinoff

To help fund Gelsinger’s comeback plan, Intel announced in December 2021 it would spin off Mobileye as a publicly traded company through an initial public offering. Mobileye has been Intel’s driver-assistance and autonomous driving solutions business since it was acquired by the chipmaker in 2017. Intel intends to take Mobileye public in mid-2022 through an IPO of newly issued Mobileye stock, but the company said it will retain a majority ownership of the company following the IPO. When Mobileye becomes a publicly traded company, it will include Moovit, which Intel acquired for $900 million in 2020, as well as Intel teams that have been working on lidar and radar technologies. Gelsinger said some of the funds from the IPO will be used to support Intel’s massive manufacturing expansion plan, which includes the new plants in Arizona and Ohio.

RealSense, Intel Sports Wind-Down

Before Intel announced its plan to take Mobileye public, Gelsinger made a few other changes to the chipmaker’s makeup of businesses. A couple months after Gelsinger’s Data Platform Group reorganization was announced, CRN reported in mid-August 2021 that Intel was “winding down” its RealSense computer vision division to focus on its core businesses, though it would continue to sell certain stereo camera products. Around the same time, Israeli news outlet Calcalist reported that Intel was shutting down the Intel Sports division and selling part of the group to Verizon. Gelsinger told CRN in an August 2021 interview that he decided to wind down the RealSense business because it did not fit in with the company’s six core businesses, which he said consisted of the Datacenter and AI Group, Intel Foundry Services, the Client Computing Group, the Network and Edge Group, the Advanced Computing Systems and Graphics Group and Mobileye. “Simply put, to each of those business leaders, they have a clear market focus. And if the assets fit one of those six business units, then I want to invest in it. If it doesn’t, then I don’t — and then how do I move out of it? It’s sort of one by one, we’re just going to rationalize everything into those business units,” Gelsinger said.

‘Software-First’ Approach

As reported in CRN’s October 2021 cover story, Gelsinger has adopted a “software-first” approach that aims to make Intel the silicon platform of choice when it comes to running a vast array of applications, from the cloud to the edge. As Gelsinger told CRN, this means engaging more independent software developers than ever before, a new level of outreach that began with the company’s first Intel Innovation event last October. But he said it also means considering new software products and services. To help him realize this vision, Gelsinger hired his former CTO at VMware, Greg Lavender, to become Intel’s CTO and lead the new Software and Advanced Technology Group. At the Intel Investor Day 2022 event last week, Lavender said Intel brought in more than $100 million in software revenue in 2021, and the chipmaker plans to “substantially grow this opportunity.” This opportunity will mostly resolve around new solutions, services and platforms that will “create new market value through software-as-a-service and subscription services,” according to Lavender.

Intel’s Embrace Of Arm, RISC-V Architectures

To strengthen the Intel Foundry Services business, Intel is opening its manufacturing capabilities to support chips made by other companies that use Arm and RISC-V instruction set architectures in addition to x86. Gelsinger announced Intel’s support for Arm and RISC-V when he first revealed Intel Foundry Services in March 2021. But the chipmaker made an even deeper commitment earlier this month when Intel announced a $1 billion fund that would, in part, support companies building chips using a mix of x86, Arm and RISC-V instruction sets. Intel’s announcement of the $1 billion fund made an emphasis on supporting the RISC-V ecosystem, which will be done in part through new partnerships with chip startups Andes Technology, Esperanto Technologies, SiFive and Ventana Micro Systems. The chipmaker also joined RISC-V International, the nonprofit that supports the open instruction set architecture. Several months before the fund announcement, Bloomberg reported that Intel reportedly offered $2 billion to acquire SiFive, which competes with Arm by licensing RISC-V processor designs to companies, but those talks reportedly came to an end in October 2021.