Michael Dell: 10 Reasons Dell’s ‘Momentum Continues’ Into 2020

Dell Technologies’ CEO Michael Dell talks to CRN about why he’s “super excited” about what next year holds for the $91 billion infrastructure giant.

Why Michael Dell Is Pumped For 2020

Michael Dell is “super excited” about Dell Technologies’ innovation strategy and sales momentum in 2020 including the launch of a new midrange storage line to his plans to dominate the Kubernetes market.

“We’re going to focus on continuing to win in our own core areas and these new areas particularly in application platforms around Kubernetes with what we’re doing with our new Tanzu platform,” said Dell in an interview with CRN. “So we’re quite excited about what we’ve achieved this past year, but momentum continues into next year with lots of opportunity for channel partners.”

The Round Rock, Texas-based $91 billion infrastructure giant has positioned itself to take revenue to the next level in 2020 in what Dell describes as the beginning of the new “data decade” with an R&D roadmap unmatched in the industry.

“Our R&D spending is quite a bit larger than any of the competitors,” said Dell. “We remain No. 1 in public and private cloud IT infrastructure, No. 1 in overall storage share, No. 1 in storage software, No. 1 in flash arrays, No. 1 in hyperconverged infrastructure, No. 1 in server revenue and units, No. 1 in PC revenues. So lots of strength and we’re not slowing down.”

Here are ten reasons why Michael Dell is bullish about 2020.

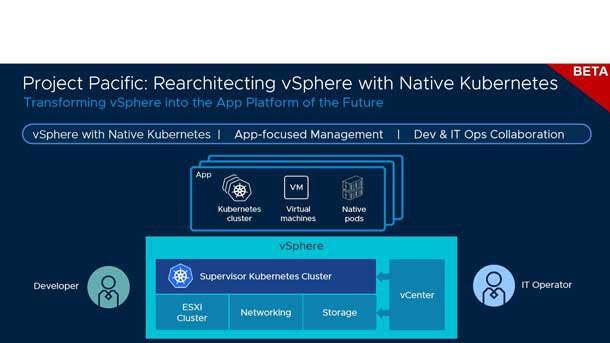

‘Super Powerful’ Kubernetes On vSphere

Dell and VMware are expecting to become the Kubernetes king in 2020 as a new, rearchitected vSphere deeply integrated with Kubernetes will launch next year. Project Pacific unites vSphere and Kubernetes to create a platform for modern applications that offers consistency across all different environments.

“With Project Pacific, we are rearchitecting a core product of VMware vSphere into a Kubernetes native platform. This is super powerful and important because we’re bringing together our application development and our infrastructure management platforms into one combined capability. The reaction from customers has been super positive. Obviously, Kubernetes has taken off because of the recognition that nobody wants to be locked into any particular form of infrastructure. So Kubernetes is really essential to a multi-cloud architecture and by building it into vSphere, and bringing it to the 600,000 vSphere customers around the world, we believe we’re super well positioned,” said Dell.

New Midrange Storage Line Coming

Dell is set to launch a new midrange storage line before the end of its fiscal year in February in a move to bring enterprise-class storage features to the midmarket. The new storage line is expected to be a micro-service, container-based architecture with top notch NVMe features and a clear migration path for current Dell EMC storage products.

“It’s a very important release to us. We haven’t said too much about what’s coming, except to say we’re super excited about it. We’ve got beta units out there. The feedback from customers has been very positive. You’ll hear more about it very soon,” said Dell. “Going back to the macro market view, our storage business grew 7 percent last quarter. We were No. 1 in every single category. We’re going to continue the innovation cycle across all aspects of storage. When you compare our growth rate to the growth rate of our competitors, it’s pretty clear that we’re continuing to win and lead that sector.”

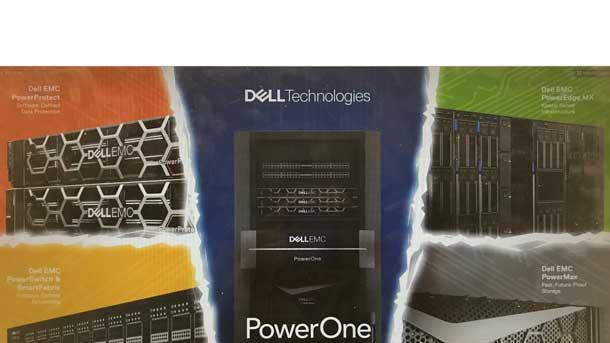

PowerOne ‘The Next Big Step’ In ‘Autonomous Infrastructure’

In one of the company’s biggest launches this year, Dell unveiled its all-in-one autonomous infrastructure, PowerOne, with game-changing automation. PowerOne contains the company’s infrastructure product lines including PowerEdge MX modular servers, PowerSwitch open networking, PowerMax storage and PowerProtect data protection along with VMware vSphere virtualizing which is all deployed, managed and maintained holistically.

“If you think about hyperconverged infrastructure (HCI) as sort of a small aspect of autonomous infrastructure, PowerOne is the bigger aspect of it. It’s essentially autonomous infrastructure for the core of the data center for large-scale applications. HCI is great, but not all applications will fit well in an HCI architecture and PowerOne takes that performance to a whole another level. Everything is integrated so the automation level is extremely high. It’s like a 96 percent reduction in the number of steps required to run these things. We continue to advance the AI that’s built into these systems. So we’re on the theme of autonomous operations for all of IT infrastructure and PowerOne is the next big step in that,” said Dell.

Complete Dominance In Hyperconverged Infrastructure

Dell plans to continue to increase its worldwide market share leadership position in hyperconverged infrastructure in 2020, led by its flagship VxRail HCI solution. This week, IDC reported Dell captured 35.1 percent global HCI market share in the third quarter 2019 with revenues topping $708 million, up 43 percent year over year.

“IDC measures the calendar quarter; our financial quarter is one month different than that. Our VxRail orders in the third quarter were up 82 percent year over year, even stronger than the IDC numbers reflect. We have a super strong position there and it’s only getting stronger. So we’re No. 1 and we’re more than twice the size of No. 2 [Nutanix]. We have our sights sets on being three-times, four-times, five-times, six-times bigger than No. 2. I think the real story is VMware Cloud Foundation which is a complete software-defined data center that can run anywhere -- it can run on-premise, it can run in any of the public clouds. We’ve enhanced our partnerships with Microsoft, our partnership with VMC on AWS, we have IBM – 4,000 other partners – but one of the reasons why VxRail grew 82 percent year over year, is that customers are increasingly figuring out that when you have that level of automation like we built into VxRail, it costs less than the public cloud, especially from a predictable workloads standpoint. So there’s tons of growth there and we have VxRail for the edge, which is starting to be a big win particularly in multi-location businesses like retail, banking, insurance, etc. I don’t see us slowing down and certainly the storage innovation continues from our team.”

Dell’s Huge R&D Wallet

With an annual R&D budget of $4.5 billion, Dell said no one will match his company’s pace of innovation in 2020.

“Our R&D spending is quite a bit larger than any of the competitors. We remain No. 1 in public and private cloud IT infrastructure, No. 1 in overall storage share, No. 1 in storage software, No. 1 in flash arrays, No. 1 in hyperconverged infrastructure, No. 1 in server revenue and units, No. 1 in PC revenues. So lots of strength and we’re not slowing down,” said Dell.

“We’re going to continue to drive investments in the core business and innovation to allow customers to simplify their IT, unlock all the power of all this data. There’s a big explosion in the amount of data. We’ve talked about the data decade and workforce modernization ahead. We’re focused on the high-value workloads around AI and ML. We’re going to continue innovation in PCs. We’re investing heavily in the multi-cloud architecture with our cloud platforms, driven by VMware Cloud Foundation and all the things we’re doing around the Dell Technologies Cloud and enabling hybrid cloud. The quarter we just finished, our storage business grew 7 percent. When you can look at most of our competitors, they were down -- minus-10 percent, minus-15 percent – we’re clearly gaining share in storage. We’re already bigger than No. 2, No. 3 and No.4 combined. VMware grew 11 percent and going back to the time of the combination of EMC, VMware, Pivotal – we’ve gained 375-basis-points in share in storage over the last two years, 480 basis-points in server share in the last three years and about 600 points in PC share in the last six years. The business is very strong.”

New Unified Global Sales Organization

Next year, Dell Technologies will combine its enterprise and sales organizations to form a new, unified organization to sled by longtime Dell EMC veteran Bill Scannell (pictured). Dell said the move will streamline the company’s go-to-market strategy and help channel partners better align with Dell to drive sales in 2020.

“Bill Scannell is taking over all of our global sales. No change to the channel organization. It will continue to be led by [Dell’s channel chief] Joyce [Mullen] who is doing a great job. Bill is an outstanding leader. He’s been with EMC since really the beginning and has done great job in leading the enterprise business for us. So now, he’ll lead the combined sales organization. [President and Chief Commercial Officer] Marius Haas did a great job at Dell for over seven years. He’s a tremendous leader, we thank him for his service and certainly with him all the best. We’ve had a lot of fun roasting him and toasting him over the last few weeks. He’s a great guy. We thank him for all of his service,” said Dell.

Server Market “Pick Up” In 2020

Dell Technologies was the worldwide leader in server revenue and units sold throughout all of 2019. Although the dominant server market share leader hit some server sale bumps this year -- with 2018 being a record year in terms of global server revenue – Dell expects this business segment to pick back up in 2020.

“It’s going to be a better year next year. Last year, was rather extraordinary for servers if you recall. We were posting quarters where we were up 30 percent, 40 percent, in a huge industry space. We remain No. 1 in servers in both revenue and units. We’re also doing a lot in our blade servers with our MX platform and integrating networking and servers together. Last year was huge in servers. This year, there’s been a bit of a digesting in all of those server investments. Next year, I think we’ll see it pick back up again,” said Dell.

Huge Windows 7 And Windows 10 Upgrade Opportunities

Microsoft is set to end support for Windows 7 in January 2020. Dell said not only is a Windows 7 refresh a big opportunity for Dell and its channel partners next year, but Windows 10 replacements as well.

“We’re continuing to see opportunities [in Windows 7 upgrades]. First of all, what’s different about this cycle than others is that we have Windows 10 machines that we sold three years ago. So there are Windows 10 machines now that are already ready to be replaced. So as we introduce the latest models of our thin and light [laptops] with extra battery life and beautiful wide screens, that Windows replacement cycle is going to continue. There are also large numbers of units out there that have still not upgraded to Windows 10. There are plenty of systems still to be replaced,” said Dell.

Unified Workspace To Drive Workforce Transformation

In a blockbuster move last year, Dell launched an integrated end-user computing solution co-engineer with VMware dubbed Unified Workspace. The offering integrates VMware Workspace ONE device management with solutions and services from Dell Technologies and SecureWorks.

“What we’re doing with Workspace ONE, with our Unified Workspace in creating a workplace productivity initiative inside customers is resonating super well. Obviously, we’re enhancing that with Carbon Black on the security front and the work we’re doing together with SecureWorks – that’s been super well received. Again, we are No. 1 in client revenues and continuing to lead that segment” said Dell.

VMware, which is owned by Dell Technologies, acquired endpoint security leader Carbon Black this year for $2.6 billion.

Container Market Domination Ahead

In addition to Project Pacific, Dell and VMware unveiled their roadmap to container domination this year through a new portfolio of products and services dubbed VMware Tanzu.

“We’re creating this Tanzu portfolio which is a set of products and services designed to help companies transform the way they build, run and manage their applications, their software on Kubernetes,” said Dell. “We’re going to focus on continuing to win in our own core areas and these new areas particularly in applications platforms around Kubernetes with what we’re doing with our new Tanzu platform. So we’re quite excited about what we’ve achieved this past year, but momentum continues into next year with lots of opportunity for channels partners.”

Dell added that since synergies between Dell, EMC and VMware started to really hit their stride, VMware has witnessed massive growth.

“I should also point out that VMware had its 14-consectuive quarter of double-digit growth, which is pretty extraordinary. If you go back on the calendar, 14 quarters ago, that’s right about the time that Dell EMC and VMware came together. So what’s occurred over the last 14 quarters has been extraordinary and it’s been very much the creation of Dell Technologies and bringing together all these capabilities, bringing them to customers with our partners. I’m super pleased with what we’ve achieved. I’m very excited about this coming year and the years ahead,” said Dell.