Nutanix CEO: 7 Big Bets To ‘Double Down’ On In 2022

From forging new channel partner investments to doubling down on its Red Hat and Citrix partnerships, Nutanix CEO Rajiv Ramaswami talks to CRN about the company’s most strategic bets ahead in 2022.

Nutanix’s Biggest Strategic Plans For 2022

Nutanix has big plans in store for 2022 around channel investments to drive solutions-oriented selling, doubling down on Citrix and Red Hat partnerships, as well as reaching a cash flow breakeven point by the end of this year, according to CEO Rajiv Ramaswami.

“We are moving to solution-oriented selling in 2022,” said Ramaswami in an interview with CRN. “So we started in [first fiscal quarter 2022] to actually piloting our new portfolio, which is really around hybrid cloud infrastructure, hybrid cloud management, unified storage and database solutions. What we want to do over time is to make sure that solution play gets scaled-out through the channel. So that’s our priority.”

The San Jose, Calif.-based hyperconverged software superstar is also “doubling down” this year on innovation around Era, Nutanix’s database automation product, as well as strategic partnerships with several key vendors.

“This next year is all about delivering on what we said we’re going to do. Delivering on a hybrid, multi-cloud vision, delivering on the growth that we said we’re going to do—25 percent ACV (annual contract value) billings growth— getting to peak by the end of calendar 2022, and building emerging products and a solutions-oriented portfolio,” Nutanix’s CEO said. “To me, 2022 is about us putting our heads down and saying, ‘Let’s go execute and deliver on what we said we’ll do. Win in the market. Win with our partners.’”

In an interview with CRN, Ramaswami explains Nutanix’s seven biggest priorities and investment areas in 2022.

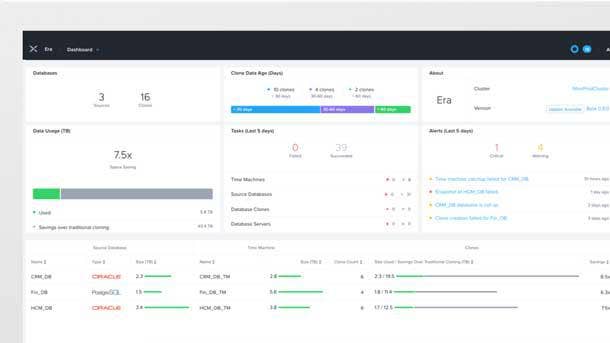

Nutanix Era

Era, which is our database automation solution, is relatively new. So there’s a ton of Nutanix innovation happening there in terms of taking Era to a true multi-database, multi-cloud automation platform. And we’re investing heavily in that in 2022 as a big bet. We’re doubling down on R&D and doubling down on our go-to-market for it.

By the way, from a channel partner perspective, Era is serving a different market there. We’re serving database administrators, not IT infrastructure folks with Era. So it’s an opportunity for channel partners to actually create another practice on top of what we offer that drives much higher pricing. Partners can be very successful businesses with Era. We are actually doubling down our investment on both R&D and go-to-market for Era.

There’s certainly potential for large Era deals. And last quarter, we talked about a large financial services company betting big on Era. Typically, these wins start out smaller, of course, so they’ll start out by looking at a particular use case for one database, and it won’t be the most mission-critical database that they have, but something below that. Once they establish the use case, then they actually go down and buy a lot more. So usually, it’s our second deal or the third deal with a customer that’s going to be bigger. The initial deals are going to be, ‘Let me try this out for one use case to see how it works. And if I like it, I’m going to go big.’ So we are excited about the potential for Era.

Double Down On Citrix And Red Hat Partnerships

We’ll be continuing to build on our strategic partnerships and execute on our strategic partnerships next year. So we’ve talked in the past about HPE and Lenovo. We talked about Red Hat last quarter.

This quarter, we formalized an agreement with Citrix. Citrix and us have been working together for a long time. We have a number of customers that run Citrix on top of Nutanix for virtual desktops. We formalized a partnership now where we have go-to-market synergies in terms of going together into the market, validating products together, executing on a giant roadmap, joint support so that customers who buy the combined solution can actually go work together, and finally mutually preferred. So they’re our preferred VDI solution for us, we are their preferred HCI platform and also hybrid multi-cloud platform, and Citrix for the cloud. So that’s the third leg of the stool for us, which is really focusing on continuing to build our partnerships.

The Red Hat partnership is going really well. We got good momentum in the first [fiscal] quarter [2022] which is really our first full quarter of the strategic partnership. It’s resulted in wins for both Red Hat Linux running on top of the Nutanix cloud platform as well as OpenShift on the Nutanix cloud platform. And we are going forward, we are expanding our go-to-market collaboration, including bringing in channel global systems integrators and our OEM partners.

Channel Investment To Drive ‘Solutions-Oriented Selling’

We are moving to solution-oriented selling in 2022. So we started in [first fiscal quarter 2022] to actually piloted our new portfolio which is really around hybrid cloud infrastructure, hybrid cloud management, unified storage and database solutions. What we want to do over time is to make sure that solution play gets scaled-out through the channel. So that’s our priority.

For example, if you look at our core HCI platform, that’s been there for a while. Now, when you look at hybrid cloud management: it’s operations management, it’s automation, it’s self-service capabilities, governance, etc. — it’s a matter of scaling out the portfolio and attaching it to our core platform.

We very much want to scale with our channel. You know, we are a $1.6 billion company. The way for us to scale is with the help our channel partners and we want channel partners to build successful practices on top of Nutanix.

No Impact From Global Hardware Supply Chain Constraint

No [big impact] for us [expected in 2022]. I think for us, it’s been essentially – we’ve seen some pull, some push, but for the most part the business impact has been minimal. Now it’s hard for me to predict here. Clearly, there’s significant supply chain constraints out there in the hardware space. No doubt about it. So we are comfortable with our second fiscal quarter [2022], I can tell you that for sure. And we’ll continue to monitor the situation here as we go by. We provided annual guidance as well and we have confidence in our growth ahead.

I think the customers definitely are paying more attention to managing their supply chain for the hardware and we see that. It hasn’t really impacted us from a software perspective in any way yet.

Make Partners Autonomous And Drive Subscription Models

One of the big priorities for us in the channel is to drive the channel to be more autonomous so that we can scale through the channel. But we don’t want to be hand holding our channel partners. Our channel partners need to be enabled. So we want to make sure they’re enabled, they’re trained on our entire portfolio, they have specialists in their teams who can sell our product portfolio and drive business. We are certainly incentivizing them with our Elevate program with channel-initiative deals coming in where they get good margin in terms of bringing deals to us and helping.

But we want to help them scale. We want to help them be able to code. We want them to be able to size. And we want them to be able to transact independently, and focus on adding services on top of that.

We want them also to adopt a subscription model. Nutanix channel partners have to move because everybody is going to a subscription model. So they have to be good at subscription—which means landing the initial deal, focusing on consumption, and then driving renewals after. That’s the mechanism they have to go with.

Free Cash Flow ‘Breakeven’ By End Of 2022

So first of all, in our recent [first fiscal] quarter [2022] we had 30 percent growth in ACV (annual contract value) billings, and 21 percent growth in revenue. We almost had free cash flow breakeven, we were very close. So we’re well on track to executing on what we said: 25 percent ACV growth over three years, every year, and free cash flow breakeven by the end of calendar year 2022.

So the business is executing as we predicted. We’re able to give annual guidance now as our subscription businesses is really coming into payments, renewals are really starting to come in and bringing more predictability into the business.

Completing Journey To Subscriptions As Renewals Kick In In 2022

If you look at our vision for 2022 and where we’re going, it’s about completing our journey to subscription. Really, this is the first big year renewals kick-in for us. And after that, we’ve already transitioned already to subscription. Our business is all subscription. But this year, we get the benefit of the renewals and getting that right. That’s what’s driving a combination of growth this year: doing that at low cost and it drives the success of our profitability and growth going forward. So executing on our hybrid multi-cloud vision with renewals kicking-in for us.

We are all about hybrid multi cloud. The cloud is an operating model, we don’t think of the cloud as a destination. A company should be able to go pick the location where they want to run their workloads based on their business needs, their budgets, and they’re going to run across multiple sites. Companies want a platform for doing that and that’s really what we provide. Nutanix provides that flexibility.