5 Things You Need To Know About VMware’s Acquisition Of Pivotal

From more firepower against IBM-Red Hat to creating a new business unit, here are five things you need to know about Pivotal now as an official subsidiary of VMware.

Why VMware’s Acquisition Of Pivotal Is So Important

Pivotal Software is now officially a subsidiary of VMware following a $2.7 billion acquisition that closed Dec. 30, 2019. Although both Pivotal and VMware are part of Dell Technologies, the merger is poised to make a major splash in the IT industry.

Both VMware and Pivotal have a bold technology strategy ahead revolving around containers, Kubernetes and cloud-native application development, with VMware creating a new business unit headed by its former global chief technology officer Ray O’Farrell.

“With the acquisition of Pivotal, VMware will go from the best infrastructure software company to the best infrastructure and developer software,” said VMware CEO Pat Gelsinger (pictured) earlier this year. “We can now serve our customers from hypervisor to developer tooling as they embark on the journey to cloud and undertake the biggest modernization in history.”

Here are the five most important things you need to know about VMware’s merger with Pivotal.

New Cloud Native Applications Team To Drive Synergies, Innovation

To prove just how important Pivotal is to VMware’s future, VMware placed its former global chief technology officer, Ray O’Farrell, in charge of its new Modern Applications Platform business unit. Pivotal employees have been combined with VMware’s Cloud Native Applications team under the newly formed Modern Applications Platform business unit.

O’Farrell is now officially executive vice president and general manager for VMware’s new Modern Applications Platform business unit. VMware is currently integrating Pivotal’s container expertise into its broader strategy around containers, Kubernetes and cloud-native strategy’s within the new business unit.

“We believe that modern application development solutions and practices need to be easily accessible to everyday enterprises across the globe,” said O’Farrell in a statement. “With Pivotal’s developer capabilities as the foundation, we’ll focus on delivering consumable, enterprise-ready cloud native offerings to customers to help them achieve better business outcomes.”

Pivotal To Supercharge VMware’s Battle Against IBM-Red Hat

VMware has its sights set on becoming the open source, container application platform standard. Its toughest competitor in this market is Red Hat’s mature OpenShift Kubernetes platform. Red Hat was acquired by IBM for a whopping $34 billion in 2019, a price tag VMware’s Gelsinger scoffed at compared to Pivotal.

“IBM spent $34 billion [on Red Hat]. I spent [$2.7 billion on Pivotal] plus add Heptio,” said Gelsinger during a Deutsche Bank Conference last year. “So I spent less than $3 billion and I think I have better assets.”

Last year, VMware unveiled the centerpiece of its Kubernetes strategy, VMware Tanzu, a portfolio of products and services slated to enhance the capabilities of VMware and Pivotal’s Pivotal Container Service (PKS), including a new cross-cloud Kubernetes management console called Tanzu Mission Control. VMware is allowing customers the option to build and deploy applications on Kubernetes using different development platforms, including an instance of Pivotal Cloud Foundry’s PaaS.

Pivotal isn’t the only company VMware acquired over the past 12 months to help steal open source container market share from IBM-Red Hat. “During the past year, we’ve completed the acquisition of Heptio for deep Kubernetes expertise. Additionally, we acquired Bitnami in May 2019. Bitnami’s packaged application catalog enables developers to quickly and easily deploy open source software onto the world’s leading cloud providers as well as on their own servers,” said O’Farrell in his blog post. “Wavefront also plays a role in supporting our customers’ modern apps needs with an enterprise observability platform that automates and unifies enterprise Kubernetes and applications visibility to enterprises.”

Making 600,000 vSphere Customers New Kubernetes Clients

One of the biggest initiatives in 2020 with Pivotal now officially under its wing, is VMware’s push to get its 600,000 vSphere customer base to adopt container technology on top of VMware’s vSphere virtualization platform. Pivotal and VMware co-engineered the popular enterprise Kubernetes platform Pivotal Container Service (PSK).

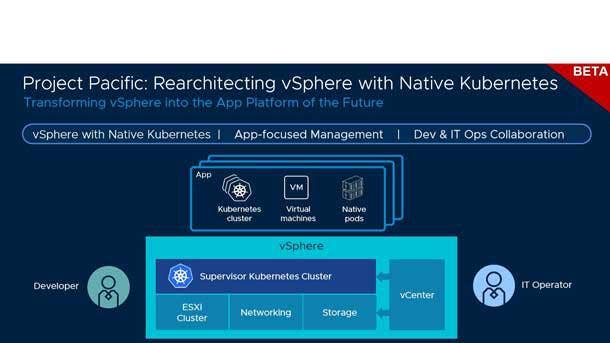

VMware, which is part of Dell Technologies, is expecting to become the Kubernetes king in 2020 with a rearchitected vSphere deeply integrated with Kubernetes. Project Pacific unites vSphere and Kubernetes to create a platform for modern applications that offers consistency across all different environments.

“With Project Pacific, we are rearchitecting a core product of VMware vSphere into a Kubernetes native platform,” said Dell Technologies CEO Michael Dell in a recent interview with CRN. “This is super powerful and important because we’re bringing together our application development and our infrastructure management platforms into one combined capability. The reaction from customers has been super positive. Obviously, Kubernetes has taken off because of the recognition that nobody wants to be locked into any particular form of infrastructure. So Kubernetes is really essential to a multi-cloud architecture and by building it into vSphere, and bringing it to the 600,000 vSphere customers around the world, we believe we’re super well positioned.”

VMware Seeks To Extend Dominance Into Application World

VMware is striving to extend its dominance of legacy IT environments into the world of containers with a heavy focus on Kubernetes, which is container orchestration engine that was once a potential threat to VMware.

VMware and Pivotal have worked closely on the technology front in the past, co-developing the highly popular PKS , which provides a platform for running containerized applications tightly integrated with existing VMware management tools already familiar to IT teams. Pivotal has doubled down on PKS over the years to give customers a platform for deploying applications built using the open source platform-as-a-service, or PaaS, environment developed under Cloud Foundry Foundation.

O’Farrell said VMware is focused on how to apply the strengths VMware has brought to the world of IT to solve the challenges enterprise face with modern application development from both a technical and cultural perspective.

“With Pivotal, VMware has expanded its talent base and the products it can utilize to help solve this problem—extending beyond IT infrastructure into application development and allowing developers to deliver the agility that the business demands. Pivotal is key to these efforts: helping companies transform by evolving their company culture to drive agility and speed of delivery in a more secure fashion and not simply by implementing new technology,” said O’Farrell in a blog post this week. “More and more, the industry has made a choice, and that choice is that Kubernetes is the bridge between the infrastructure layer and the containerized applications running upon it.”

Pivotal’s Heritage And Fall

On Dec. 30, 2019, Pivotal became a subsidiary of VMware and is no longer a publicly traded company on the New York Stock Exchange. However, it is important to take a quick look back on Pivotal’s heritage and turbulent past 12 months before being acquired.

Founded in 2013, Pivotal was created by a combination of EMC and VMware – all of which were bought by Dell Technologies in 2016. Over the years, Pivotal raised a total of $1.7 billion before going public in 2018. The company’s stock was riding at well over $21 per share in May 2019 before plunging 40 percent to $8.30 per share by August after lowering its revenue targets following a poor quarterly earnings report . During that same time period, Pivotal market cap fell from $5.8 billion on May 30 to $2.2 billion on Aug. 14. In August, reports surfaced that VMware was in talks to acquire the company.

O’Farrell said his mission to develop with Pivotal a “complete stack” -- from infrastructure to application -- to help enterprises build, run and manage modern applications. “Foundational to this stack will be innovative open source technologies such as Kubernetes, PAS and Spring,” he said. “I can’t wait to get started down this journey now that the Pivotal team is on board.”