Gartner’s Magic Quadrant For CRM: The Top 14 Vendors In 2019

Salesforce, Oracle and ServiceNow are just a few of the 14 vendors who made Gartner’s 2019 Magic Quadrant for the CRM Customer Engagement Center.

The Top 14 CRM Customer Engagement Center Vendors Worldwide

Businesses are changing the way they engage with customers and manage customer service teams by driving innovation around new artificial intelligence technology and bold digital business models, according to Gartner’s new 2019 Magic Quadrant for the CRM Customer Engagement Center.

Gartner says that by 2022, 70 percent of customer interactions will involve emerging technologies such as machine learning applications, chatbots and mobile messaging. That figure is a huge increase from only 15 percent of customer interactions in 2018. Additionally, organizations that are part of a connected digital business ecosystem will have 40 percent of their customer service cases initiated by CRM vendors in that ecosystem by 2023, according to Gartner.

Gartner defines CRM Customer Engagement Center (CEC) as the market for software applications used to provide customer service and support by engaging both proactively and reactively with customers by providing advice and solving problems. The best CEC applications today have solutions for both agents and customers.

Here are the 14 market leading vendors in the space who made Gartner's 2019 CRM CEC Magic Quadrant, along with assessments of each company's strengths and weaknesses in the space.

Gartner’s CRM Methodology

In order to make Gartner’s Magic Quadrant, vendors needed to have at least $7 million in new revenue from software for core customer service, appear regularly on client shortlists, show sufficient professional services to fulfill current customer demands over the next six months, have a minimum of 15 customers using the latest version of its software for their customer service and support function, and be a “trendsetter” or “market mover” based on its software and strategy -- to name just a few of Gartner’s criteria. Vendors also need to have a clear view about how to escalate customer support from digital self-service to human agent.

Gartner's Magic Quadrant ranks vendors on their ability to execute and completeness of vision and places them in four categories: Niche Players (low on vision and execution), Visionaries (good vision but low execution), Challengers (good execution but low vision) and Leaders (excelling in both vision and execution).

Leader: Salesforce

The San Francisco-based CRM software specialist stood out from the crowd as the clear leader in both execution and vision on the Magic Quadrant. No other vendors was close to Salesforce leadership position on the quadrant as the company reported revenue of $3.6 billion in 2018 from customer service subscription and support, up 26 percent year-on-year. More than 70 percent of the CEC customers who Gartner contacted shortlisted Salesforce Service Cloud as either their first or second choice. Salesforce acquired MuleSoft last year for $6.5 billion in a move to add new integration and API management platform to Salesforce’s product portfolio. In a blockbuster announcement in June, Salesforce unveiled plans to buy Tableau Software in an all-stock deal worth around $16 billion, the largest in the company’s history.

Strength: Customers view Salesforce not just as a CRM software provider, but as a strategic advisor that helps grow their overall business and innovation strategy.

Weakness: Reference customers cited a lack of native integration between different Salesforce Clouds as well as concerns about high prices.

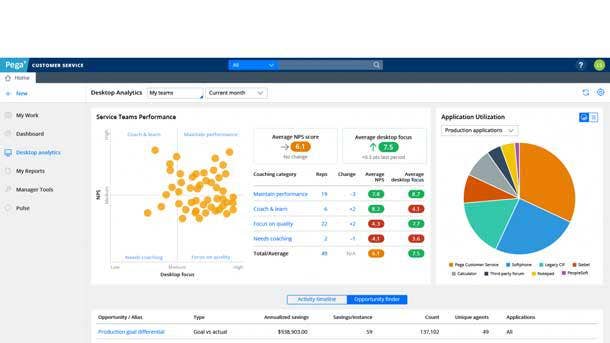

Leader: Pegasystems

The Cambridge, Mass.-based company ranks as a ‘Leader’ in the Magic Quadrant mainly because of the company’s ability to address complex customer service goals, investment in clients success and its low-code innovation strategy. The company ranks No. 2 in both execution and vision on the Magic Quadrant. Pegasystems specializes in customer engagement and case workflow automation capabilities, which are part of its Pega Customer Service product. Pegasystems offers Platform-as-a-Service (PaaS) application developer capabilities to complement its CEC solution. The company reported $950 million in total revenue last year, up 12 percent year-on-year, with more than 50 percent coming from CRM applications and CEC software licensing. In June, Pegasystems launched new digital messaging capabilities within Pega Customer Service allowing clients to seamlessly connect with customer regardless of which messaging application they choose.

Strength: Pegasystems’ low-code innovation makes it simple to extend its solution and combine third-party technologies, customer touchpoints, workflows and AI to provide a differentiated end-to-end customer experience.

Weakness: The company received the lowest score out of all the vendors on the Magic Quadrant from references customers in terms of cost relative to value delivered.

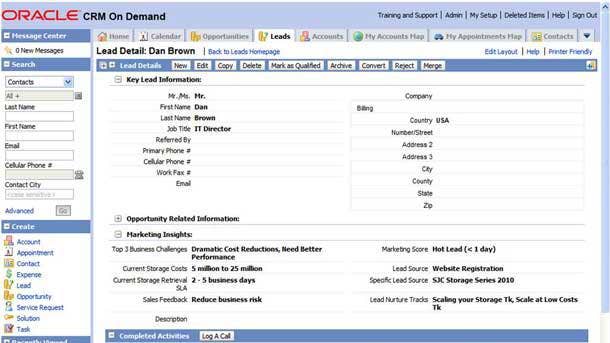

Leader: Oracle

With offices in 175 countries, Oracle has a global sales strategy for Oracle Service Cloud, which is a set of customer service applications that are part of Oracle’s CX Cloud Suite. The Redwood Shores, Calif.-based company ranks No. 3 for vision and No. 4 in execution on the Magic Quadrant. Oracle’s Service Cloud has received multiple innovation injections from a slew of acquisitions over the years including RightNow Technologies, LiveLOOK for co-browsing technology, InQuira and TOA Technologies for filed service management. The company also has a strong vision in terms of Internet of Things offerings as well as Oracle Policy Automation (OPA) workflow options. Oracle recently teamed up with Microsoft to link their clouds in order to allow joint customers to migrate and run enterprise workloads across Microsoft Azure and Oracle Cloud.

Strength: Oracle has built out a solid ISV ecosystems to enable smoother integrations with the Oracle Cloud Marketplace that has around 575 listings, including some specific to Oracle Service Cloud.

Weakness: Reference customers indicate that Oracle Service Cloud is weak around support for virtual assistants, messaging and chatbots.

Leader: Zendesk

Zendesk has the fastest-growing customer base of any vendor in the market tied with a strong pace of innovation. Zendesk combines a customer communication hub strategy with engagement orchestration features to form the base of its CEC application. The San Francisco-based company offers its customer service product only as a SaaS solution based on an innovative help desk application. With 2,700 employees worldwide, the company generated nearly $600 million in revenue last year based entirely on its CEC offering. The company is ranks No. 3 for execution and No. 4 for vision on the Magic Quadrant. Zendesk recently acquired startup Smooch Technologies in a move to deliver better omnichannel experiences.

Strength: The company consistently launches new products and features such as deeper integration with workstream collaboration technology and its own public cloud solution, Zendesk Sunshine.

Weakness: Zendesk focus on simplicity resulted in customer service centers finding its interface less intuitive when managing large numbers of advisors, with only a small percentage of Zendesk customers having 500 or more seats.

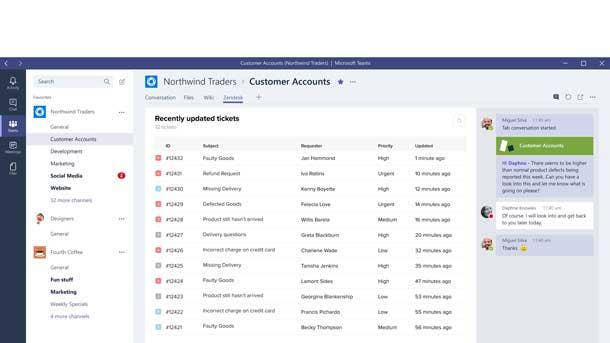

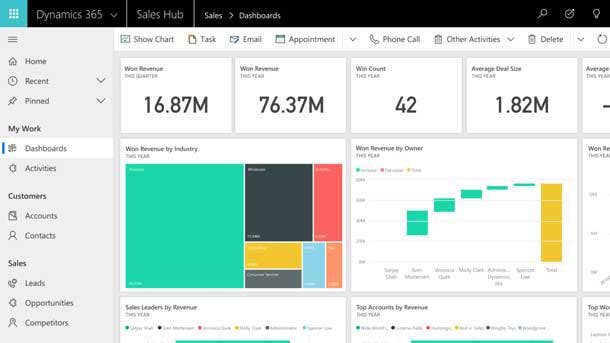

Leaders: Microsoft

The Redmond, Wash.-based software giant provides CEC capabilities through its Dynamics 365 for Customer Service solution that includes AI applications, customer service and field service. Microsoft reported more than 50 percent growth in Dynamics 365 sales over the past year. The company’s Unified Service Desk application offers configurable user experiences and engagement orchestration. Microsoft ranks No. 5 for execution and amongst the top half of the group for vision on the Magic Quadrant. The No. 2 public cloud leader is set to revamp its Microsoft Partner Network ahead of its Inspire partner conference next month.

Strength: Microsoft uses native AI to reduce the need for data scientists and developers for Dynamics 365 for Customer Service. The company’s AI innovation drives customer decision making and helps identify automation opportunities.

Weakness: Microsoft scored the lowest of all the vendors in the Magic Quadrant in terms of responsiveness and competency of vendor-supplied customer service and technical support.

Challengers: SAP

Although SAP is only a ‘Challenger’ in the quadrant, which is due to a lack of clear vision, Gartner points at SAP’s acquisitions of Callidus Software, Contextor, Qualtrics and Recast.AI as a renewed approach centered on the customer and employee experience. SAP Service Cloud is a multitenant SaaS solution that supports multiple delivery models. The Germany-based software application specialist is striving to deliver next-generation CEC solutions through its Intelligent Enterprise and Experience Economy strategies. SAP reported $1.06 billion from customer experience sales in 2018, up 52 percent from 2017. SAP ranks amongst the middle of the pack for both execution and vision on the Magic Quadrant.

Strength: The company allows customers to connect all SAP applications within its cloud suite with SAP C/4HANA and SAP HANA Data Management Suite at the center of a transformation to make clients more customer-centric.

Weakness: Reference customers gave SAP the lowest scores of any major CEC vendor in terms of functionality, promises made about software and responsiveness.

Visionary: ServiceNow

The Santa Clara, Calif.-based company is rapidly growing its cloud and SaaS business applications as total revenue jumped 36 percent year-on-year to $2.6 billion in 2018 The ServiceNow Customer Service Management application helps companies resolve issues end-to-end, proactively fix customer problems and drive actions to instantly take care of customer requests. ServiceNow enables customers to deliver strong customer experience and increase efficiency by combining engagement capabilities with service management and operational abilities for monitoring, diagnosing and proactively resolving issues. The company ranks No. 5 for vision and among the middle of the pack for execution on the Magic Quadrant. ServiceNow CEO John Donahoe recently spoke to CRN about the company overhauling its partner program as well as new partnerships with Google Cloud and Deloitte.

Strength: ServiceNow’s workflow and case management functionality received high scores from customers as well as for its ease of configuration and modification.

Weakness: Reference customers cited the company’s complex and confusing licensing models while also highlighting the high cost of ServiceNow’s solution.

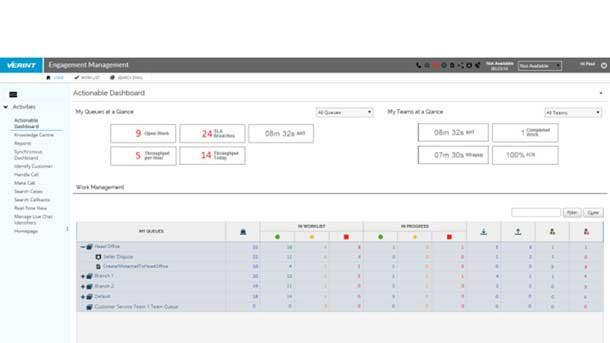

Niche Player: Verint Systems

With 60 offices worldwide, Verint Systems’ flagship CEC solution is an omnichannel platform with centralized knowledge, case, workflow and customer history features. The company is expecting to generate nearly $900 million in revenue in its current fiscal year 2020 from customer engagement solutions. Verint has boosted its strategy by using different AI functional domains of Next IT, a company Verint acquired in 2017. The company recently released the Verint Unified VoC, providing customers with a complete view of direct, indirect and inferred Voice of Customers (VoC) with an automated analytics engine to deliver actionable insights. Verint Systems ranks among the middle of the pack for both vision and execution on the Magic Quadrant.

Strength: The renewed knowledge management capability within Verint Engagement Management is highly rated by customers.

Weakness: Although Verint is growing its channel partner base, customers gave the company lower-than-average scores for its use of software partners and implementation partners compared to other vendors on this list.

Niche Player: Appian

The publicly traded company has a strong focus on large enterprises and vertical markets including financial services and the U.S. federal government. New to the Magic Quadrant, Appian focuses on low-code application development and business process management markets. The company provides case-centric applications and expanded into customer engagement last year with the launch of its Intelligent Contact Center (ICC) solution. For its fiscal year 2018, Appian generated sales of $227 million, up 28 percent year-on-year, although CRM CEC represents only a small portion of the company’s total revenue. The Tysons, Va.-based company recently formed a partnership with Twilio to integrated Twilio’s communication platform into Appian’s ICC. Appian ranks among the middle of the pack for both vision and execution on the Magic Quadrant.

Strength: The Appian AppMarket offers over 350 tools, accelerators and extensions built on the platform by Appian and its partners.

Weakness: The company doesn’t have a native CEC offering with a software release cycle attached, relaying on partnerships with the likes of Google and Twilio for additional CEC capabilities.

Niche Player: Freshworks

The San Mateo, Calif.-based company has long been a ‘Niche Player’ in the Magic Quadrant due to its steady offer of CEC solutions to mostly small businesses. Freshworks has seven main product lines including tools for marketing, sales, customer support, IT support and human capital management. The company’s Freshdeck customer service solution for SMBs is deployed in over 120 countries with the majority of customers being in the U.S. and EMEA. Freshdeck helps enable better customer conversations with a focus on internal collaboration beyond agents. The company ranks among the middle of the pack for vision and amongst the bottom for execution on the Magic Quadrant.

Strength: The Freshworks Marketplace has over 400 applications and connectors to support its products while also creating an ecosystem for developers and partners.

Weakness: Reference customers gave the company relatively low scores for functionality or promises made regarding software. Freshworks’ needs to manage expectations about Freshdesk suitability for complex use cases.

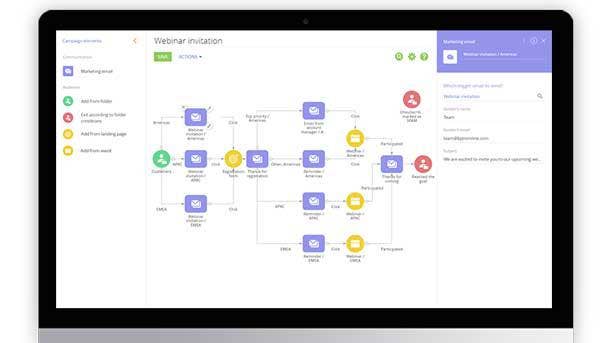

Niche Player: bpm’online

Bpm’online Service is an intelligence service management, lower-code platform that is part of a bigger solution for sales, service and marketing. The Boston-based company’s strength is in its intuitive user interface, business process modeling capabilities and appealing costs compared to other large enterprise CRM systems. Bpm’online .NET-architected application is available both as a cloud version as well as on-premise. The company’s products are easy to configure and modify with the majority of customers hailing from Europe. Bpm’online, who received a 5-Star rating in CRN’s 2019 Partner Program Guide, ranks among the middle of the pack for execution and amongst the bottom for vision on the Magic Quadrant.

Strength: Bpm’online’s scalability and security are a standout. Its solution receiving the highest customer scores for ease of use of all the products evaluated on the Magic Quadrant.

Weakness: Customers expressed concern about the company’s training, documentation and project planning. Surveyed bpm’online customers also reported challenges in terms of data migration and real-time integration in complex environments.

Niche Player: eGain

The Sunnyvale, Calif.-based company offers a suite of customer engagement solutions with a focus on digital engagement combined with knowledge management, AI and analytics capabilities. eGain offers certified integrations with leading contact center infrastructure and CRM providers with a customer base of mostly enterprises and midmarket companies. The publicly traded company reported 40 percent growth in SaaS revenue in 2018 year-on-yea. eGain’s ‘Innovation in 30 Days’ technology consumption model, where customers test its product for a few weeks at no charge, has a conversation-to-sale rate of more than 70 percent. The company ranks among the bottom of the pack for both vision and execution on the Magic Quadrant.

Strength: eGain is one of the first companies to specialize in digital engagement channels through a broad offering that includes email, chat, chatbot, virtual assistant, social and messaging support, co-browsing and notifications.

Weakness: Customers have a limited choice of implementation services other than eGain’s professional services. The company needs to expand its professional services arm to meet the needs of a growing customer.

Niche Player: SugarCRM

The Cupertino, Calif.-based company’s primary CEC solution, Sugar Enterprise, highlights SugarCRM’s core capabilities in knowledge management, guided workflow and self-service portals. SugarCRM focuses on the ability to integrate with contact center platforms and legacy contact center technology. The company generated around $120 million in 2018, with approximately 10 percent coming for CEC sales. In May, SugarCRM acquired SaaS marketing automation specialist Salesfusion. SugarCRM has yet to offer a product dedicated to customer service with its clients largely consisting of existing SugarCRM sales and marketing CRM application customers. The company ranks last in vision and among the bottom of the pack for execution on the Magic Quadrant.

Strength: Reference customer scores by Gartner put SugarCRM in the top five vendors for workflow, real-time guidance and mobile app support.

Weakness: The company received the lowest score in the Magic Quadrant survey for advanced functional capabilities such as virtual customer assistant. Awareness of the SugarCRM brand is low, especially outside the U.S. and Western Europe.

Niche Player: CRMNEXT

India-based CRMNEXT focuses on its strength in supporting large customers mostly in Asia/Pacific and parts of the Middle East. The company’s CEC solution, CRMNEXT Service Management, is part of a complete CRMNEXT platform that includes customer service, sales, marketing and digital journey capabilities. Its top-five clients each support over 10,000 users. Around 80 percent of its total revenue comes from the financial advisor area, especially in the retail banking and insurance sectors. CRMNEXT ranks last in execution and among the bottom of the pack for vision on the Magic Quadrant.

Strength: The company has created an application framework that enables organizations to design their own business flows. CRMNEXT’s ability to scale is key, as the vendor’s largest customer has over 300,000 daily users.

Weakness: CRMNEXT’s reach is mostly tied down to India with little traction in the U.S. and Europe. Customers have little third-party knowledge to choose from as an alternative to CRMNEXT’s resources for consulting services.