The Top 10 Biggest VMware News Stories Of 2019

From spending billions on acquisitions to forming new partnerships with public cloud titans, CRN breaks down the top ten biggest VMware stories of 2019 that will reshape the company next year.

VMware Disrupts Itself In 2019 To Prepare For Future

The virtualization superstar disrupted itself in 2019 by launching an R&D and innovation assault on the cybersecurity, hybrid cloud and Kubernetes markets in one of most important year’s in VMware’s history.

At the same time, the Palo Alto, Calif.-based company formed strategic partnerships with the likes of Google and Microsoft to open new opportunities while at the same time tightening integrations with its majority owner Dell Technologies. VMware’s fearless leader Pat Gelsinger – who was voted best CEO in America in 2019 by Glassdoor among all U.S. large companies – took several bold risks this year, yet at the same, was able to continuously grow sales every quarter.

With top notch leadership and a growing portfolio that would make any IT company jealous, VMware has positioned itself as an extremely strong and diverse company heading into 2020. CRN breaks down the ten biggest VMware stories of 2019.

Get more of CRN's 2019 tech year in review.

10. VMware’s Goes On Acquisition Tear In 2019

From machine learning and artificial intelligence to cybersecurity and software-defined networking, VMware is slated to make a total of nine acquisitions this year, making 2019 one of the company’s busiest years in history in terms of M&A.

VMware spent billions on acquisitions that include Aetherpal to boost VMware’s Workspace ONE; application and AI-focused BitFusion and Uhana; application security startup Intrinsic; and application deployment specialist Bitnami. Arguably its two biggest acquisitions of the year, Carbon Black and Pivotal Software – which will be discussed later on this list – will help drive sales and innovation for years to come.

Another pair of important acquisitions on the networking front include Veriflow, which applies continuous verification to networks to prevent outages and vulnerabilities, and multi-cloud application delivery startup Avi Networks. Founded in 2012 by former Cisco executives, Avi Networks is deployed in hundreds of global enterprises and aims to bring public cloud experience to the data center by creating what the company dubs as the “industry’s only complete software-defined networking stack” built for the modern multi-cloud era.

This slew of acquisitions had set the stage to drive deep integration and high-level innovation across VMware in 2020.

9. VMware Cloud Foundation Comes To Google Cloud; New VMware Cloud on AWS Competitor is Born

VMware branched out significantly on the public cloud partnership front in 2019. One of the biggest news of the year came this summer when Google and VMware executives met on stage to unveil that Google Cloud will begin supporting VMware workloads.

“Both Google Cloud and VMware believe that customers want to run workloads in the cloud that works best for them,” said Google Cloud CEO Thomas Kurian at the time. “Customers have asked us to provide broad support for VMware, and now with Google Cloud VMware Solution by CloudSimple, our customers will be able to run VMware vSphere-based workloads in GCP.”

Google Cloud VMware Solution by CloudSimple leverages VMware Cloud Foundation infrastructure software running on Google Cloud Platform (GCP). IT startup CloudSimple provides technology that makes the running of VMware workloads natively on GCP possible.

In a move to potentially turn up the heat on its main competitor AWS, Google acquired CloudSimple in November. Google Cloud VMware Solution by CloudSimple is similar to VMware Cloud on AWS, which allows VMware software-defined data center workloads run natively on the AWS Cloud. The new Google Cloud partnership will open new customer doors for VMware in 2020.

8. VMware Takes Aim At Nutanix

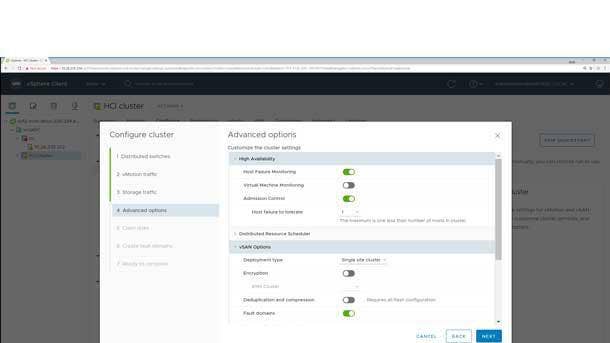

VMware overtook Nutanix this year as the visionary leader in Gartner’s 2019 Magic Quadrant for Hyperconverged Infrastructure while also coming neck-in-neck in terms of execution. VMware launched a slew of new innovation including revamping NSX-T Data Center with advanced automation, intrinsic security and network infrastructure as code, as well as updating vSAN 6.7 with native support for persistent storage for containers and operations management simplification.

“I think Nutanix has sort of reached the end of their strategy. Where do they go from here?” said Gelsinger in an interview with CRN this year. “We respect Nutanix as a competitor, they helped create the category, but now I’d say we have a better product, a better strategy and a much better vision of where that’s going.”

In terms of hyperconverged software, VMware extended its market leadership position by capturing 38 percent of the worldwide software share while Nutanix’s share dropped year over year to 28.6 percent in IDC’s most recent quarterly HCI report. VMware is striving to become the software subscription kingpin of the modern hybrid cloud world where hyperconverged infrastructure will play a major factor.

7. New ‘Game-Changer’ VMware Partner Connect Unveiled

Dubbed as a channel “game-changer” by VMware’s global channel chief Jenni Flinders, VMware unveiled its new partner program in 2019 that will redefine how the company interacts and conducts business with solution providers.

“If we are going to double our revenue in a few years, the only way we’re going to do that is through one hell of a healthy partner ecosystem that is co-selling with us,” said Flinders, vice president and Global Channel Chief for VMware. “If any partner comes to me saying, ‘Hey, I want more rebates,’ that’s the wrong conversation to have. It’s more around, ‘How do we extend your business models? And how do we help you build more practice areas?’”

VMware Partner Connect aims to simplify VMware’s current channel programs by replacing them with a single program and a single agreement with a common incentive model, fee structure and requirements. The new program is geared toward partners who achieve Master Services Competencies by providing them with the most rewards including deployment and consumption incentives, co-selling opportunities and prioritization for joint-business planning with VMware.

VMware Partner Connect will officially launch on Feb. 29, 2020.

6. VMware Meets Long-Time Rival Microsoft With Open Arms

In a historic moment, Microsoft CEO Satya Nadella, Dell Technologies CEO Michael Dell and VMware’s Gelsinger stood on stage with each other at Dell Technologies World this year. The three industry titans unveiled a highly anticipated cloud alliance between VMware and Microsoft with a joint solution that will natively bring VMware environments into the Azure Cloud.

Azure VMware Solutions hit the market this year which includes all technologies in VMware Cloud Foundation -- including vSphere, NSX and vSAN -- to provide native and certified VMware infrastructure on Microsoft Azure. Because the service integrates with native Azure services, it will simplify the process of adding capabilities like artificial intelligence and the Internet of Things into VMware-based applications.

Michael Dell was bullish about the alliance, saying there’s “lots of demand for” the VMware-Microsoft solution. “As you can see, we're innovating a whole new level of cloud-agnostic interoperability for your workloads,” he said.

Due to high customer demand, Microsoft recently expanded the availability of Azure VMware Solutions across the United States, Western Europe and Asia-Pacific. Other solutions expected to stem from the partnership in 2020 include a jointly integrated Microsoft 365 and VMware Workspace ONE solution as well as Azure VMware Solution by Virtustream.

5. VMware Sales Grow Double-Digits Every Quarter

What has sometimes been lost in VMware’s constant news cycle is the company’s massive revenue growth during every quarter of calendar year 2019.

For VMware’s fourth fiscal quarter 2019, which ended Feb. 1, 2019, the company reported revenues of $2.6 billion, up a whopping 16 percent year over year. In the company’s first fiscal quarter 2020, VMware notched nearly $2.3 billion in total revenue, up 13 percent compared to the same quarter one year ago. For VMware’s second fiscal quarter 2020, the company reported overall sales of $2.44 billion, up 12 percent year over year. Finally, in VMware’s most recent third fiscal quarter, the company generated $2.46 billion on revenue, up 12 percent from the same quarter of the previous year.

Additionally, the company’s shift to Software-as-a-Service has made SaaS sales a larger percentage of VMware’s total revenue as part of its goal to transition to subscription sales. VMware reported year over year increases in license revenue during each of its four quarters in 2019. VMware says acquisitions such as Pivotal Software and Carbon Black will further shift the balance of revenue to a subscription model.

4. Dell Integrations At All-Time High

The integration and co-engineering between Dell and VMware hit an all-time in 2019, which has been paying off in big channel sales gains.

VMware and Dell unveiled this year perhaps its most significant cloud collaboration ever with the Dell Technologies Cloud. The foundation of the new hybrid cloud platform is VMware Cloud on Dell EMC hardware. Additionally, Dell launched its new PowerOne autonomous infrastructure that combines all of Dell EMC’s flagship infrastructure products together with VMware vSphere in a single architecture with future plans to integrate VMware Cloud Foundation into the mix.

The two companies have doubled down on hyperconverged infrastructure integration around VxRail, launched a new SD-WAN solution together as well as a joint Unified Workspace end-user computing product. Hundreds of VMware and Dell engineers are now working hand-in-hand to drive innovation together.

“We see that these technologies and the momentum that we’ve built, the solutions that we’ve architected over the last 18 months, is really positioning us like no one else,” said Gelsinger in front of over 4,000 Dell Technologies partners at Dell’s Global Partner Summit this year. “We’re seeing this relationship as gaining momentum. We’re seeing it as enabling these new solutions. We’re partnering across our ecosystem, but this relationship with Dell and VMware is unique and powerful. We have defied gravity.”

3. VMware’s Blockbuster Pivotal Software Acquisition

In a blockbuster DevOps and Kubernetes move this year, VMware unveiled it had entered into an definite agreement to acquire Pivotal Software for $2.1 billion. The software developer star is owner of the popular enterprise Kubernetes platform Pivotal Container Service (PSK). VMware will leverage Pivotal to evolve vSphere into a native Kubernetes platform for VMs and containers.

“With the acquisition of Pivotal, VMware will go from the best infrastructure software company to the best infrastructure and developer software. We can now serve our customers from hypervisor to developer tooling as they embark on the journey to cloud and undertake the biggest modernization in history,” said Gelsinger this year.

Pivotal spun out of VMware years ago and both are members of the Dell Technologies family of businesses. The move will also bolster channel partners across all of Dell Technologies, said Dell’s President and Chief Commercial Officer Marius Haas. In an interview with CRN, Haas said, "By putting [Pivotal] inside of VMware, now we've got a tremendous software development application platform sitting on top of an amazing industry-leading management platform for our customers and our partners.” The deal is expected to close by the end of January 2020.

2. VMware Disrupts ‘Broken’ Security Industry With Carbon Black Buy

In 2019, VMware’s made it known that it would no longer be dipping its toe into the global security market leadership discussion, but instead make a giant slash. That splash came in the form of a $2.6 billion acquisition of endpoint security leader Carbon Black.

“In endpoint security, the traditional players are not innovating. They’ve become fossils almost— Symantec, McAfee,” VMware’s Sanjay Poonen, chief operating officer, Customer Operations in an interview with CRN. “In VMware’s hands, Carbon Black will do better than they are doing on their own because of the distribution presence that we’ll bring to them, the integration possibilities of it, and so much more.”

VMware’s CEO throughout 2019 hailed the security market as “broken” and “overly complex” for enterprises who own hundreds of siloed security products. VMware unveiled its strategy this year to make security intrinsic throughout its portfolio. At the same time, the company introduced a slew of innovation this year, including its new Service-Defined Firewall to provide intrinsic security by leveraging its position in the hypervisor for full stack visibility and control of applications and the services that comprise them.

“We do think of it as a very radical innovation as we go think about security from an application [standpoint]” said Gelsinger, in an interview with CRN. “We have two assets that nobody else on the planet has. We have the VM [virtual machine]. We’re building this intrinsically into the VM.”

In November, VMware made Carbon Black’s new cloud security portfolio available for partners to sell for the first time with Carbon Black now operating as a VMware division under the leadership of its former CEO Patrick Morley.

1. VMware Becomes A Kubernetes-Container Force, Launches Tanzu

Arguably VMware’s biggest investment and market-changing news in 2019 was its strategic move to become the “world-standard” for containers and Kubernetes. At one time, containers appeared to be a threat to the virtualization leader. However, VMware became the second largest contributor to Kubernetes in 2019 thanks to organic innovation as well as the acquisitions of Bitnami and startup Heptio, which was founded by two of the original creators of Kubernetes technology. Additionally, Red Hat’s Kubernetes star Grant Shipley jumped ship to VMware this year as its new senior director of Kubernetes.

“We want to be seen as the enterprise dial-tone for Kubernetes,” said Gelsinger in an interview with CRN. “We’re embracing Kubernetes as the native dial-tone for the VMware stack going forward. So you’ll see us build more and more of those capabilities into the core VMware platform.”

The company unveiled the centerpiece of its Kubernetes strategy at VMWorld 2019 with VMware Tanzu, a portfolio of products and services slated to enhance the capabilities of VMware PKS. Tanzu has a cross-cloud Kubernetes management console called Tanzu Mission Control, which is now in beta testing with customers, to yield a fully native Kubernetes environment within vSphere. Tanzu is the onramp for PKS customers to broaden their abilities to build, run and manage any application on any device in any cloud.

In a recent letter to Pivotal employees, Poonen said, “VMware’s ambition is to become the world-standard for containers and Kubernetes, with the power of Pivotal, Heptio, and Bitnami.” In 2020, VMware has the ability to truly do just that.