5 Things To Watch For At Dreamforce 2019

Salesforce partners are eager to glean more knowledge about the company's product direction, channel goals and enterprise growth strategy.

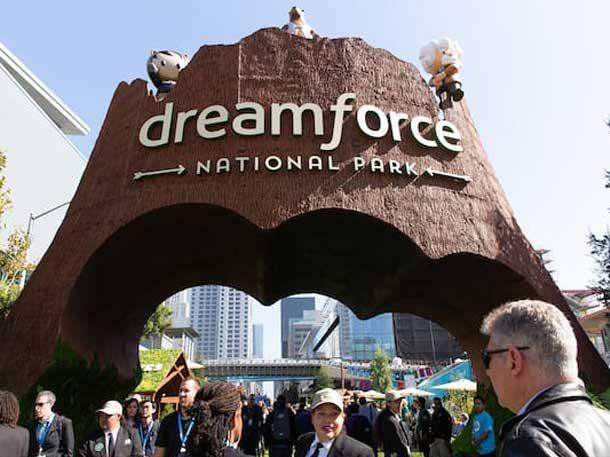

Dreamforce In Sight

Salesforce's mega-conference is gearing up again for another explosion of tech, business, philanthropy and networking in a style and on a scale like no other event.

Partners of the CRM giant are arriving in San Francisco eager to glean more knowledge about the company's product direction, channel goals and enterprise growth strategy as Salesforce looks to double its business over the next four years by leveraging a rapidly expanding channel.

With Salesforce having recently completed its largest-ever acquisition of Tableau Software, and an expanding portfolio of cloud services being enhanced with artificial intelligence and integration capabilities, Dreamforce should provide plenty of fodder for the Salesforce enthusiast.

Here are five things to watch for at Dreamforce 2019.

Tableau Time

Salesforce closed its Tableau Software acquisition in quick-time this summer, and now its newest and most-expensive subsidiary is ready to be showcased to a Dreamforce audience.

It's not clear if Tableau will be presented as an entirely independent solution, or if Salesforce will use the leading BI platform it bought for $15.7 billion in stock to hint at or launch an entirely new product. But we're likely to see plenty of integrations with Salesforce clouds and the Einstein analytics platform.

When the deal was announced, partners were anticipating Tableau to deliver them a competitive advantage in an enterprise market clamoring for the ability to draw quick insights from increasingly large data sources.

Last week, Seattle-based Tableau held its own customer and partner conference in Las Vegas, at which Salesforce founder and co-CEO Marc Benioff was a keynote speaker.

Tableau unveiled a new global partner program that sees it rely more on partners to help customers develop “data cultures” and expand their use of Tableau’s business analytics and data management software.

Tableau also revealed an alliance with AWS and three strategic service partners in an initiative to get businesses and organizations—especially those using legacy BI software—to move their analytics operations to the cloud.

Microsoft Momentum

At Dreamforce 2017, Salesforce announced Google as a "preferred" cloud provider, which didn't override the same status AWS had already established with the CRM leader.

Salesforce is certainly hyper-scale promiscuous, and now it's focusing on driving its relationship with Microsoft.

Last week, Salesforce named Microsoft Azure the public cloud provider for its Marketing Cloud. At the same time, it revealed a new integration between Salesforce Sales and Service Clouds with Microsoft Teams—Microsoft’s communication and collaboration platform—which is expected to go active in late 2020.

Moving Marketing Cloud to Azure will allow Salesforce to optimize its performance as customer demand scales, cutting onboarding times and enabling customers to expand more quickly under Azure's global reach while helping to address local data security, privacy and compliance requirements, the companies said.

While Salesforce already has "preferred" cloud relationships with both of Microsoft's top competitors—AWS and Google—Marketing Cloud has primarily run on the company’s own infrastructure.

It'll be interesting to see if Dreamforce presents an opportunity to further advance or promote the Microsoft relationship.

Integration Initiatives

Last year, as expected at the time, Salesforce introduced its Integration Cloud at Dreamforce.

What wasn't expected in 2018 was that MuleSoft technology would be at the center of a larger vision that Salesforce dubbed Customer 360, aiming to offer its users a more-comprehensive view of their own customers.

New Customer 360 capabilities were delivered through a point-and-click interface connecting data across all the Salesforce clouds (Sales, Service, Marketing, Commerce), and MuleSoft's platform was put to work connecting Salesforce's portfolio to other technologies in the enterprise, such as human resources and ERP systems.

Customer 360 was released as a default option to all customers.

Salesforce has now had more than a year to digest MuleSoft and might present a more-mature Customer 360 go-to-market strategy at this year's event.

Partner Outlook

Salesforce is looking to double its business in the next few years, and that's only possible if it can maintain the pace of an ambitious expansion of its partner base.

The company's channel has mushroomed in recent years, but to reach the lofty $26 billion goal articulated by co-CEO Marc Benioff, Salesforce estimates it will need a whopping 250,000 partners.

"Partners are the lifeblood of what Salesforce is doing now and are going to be a critical part of achieving $26 [billion] to $28 billion," J.C. Collins (pictured), Salesforce's senior vice president and COO of industries, innovation and partners, told CRN in March.

Ramping its channel involves helping existing consultancies scale while encouraging the formation of startups and recruiting legacy solution providers looking to establish cloud practices, Collins told CRN.

We'll see if Salesforce unveils new strategies at Dreamforce to build on the capabilities of its existing go-to-market ecosystem and recruit new consultancies at an impressive clip for an established enterprise software vendor.

Upgraded App Store

Salesforce has been bulking up its AppExchange marketplace with new apps and packages built by partners in line with the company's Customer 360 strategy.

A few weeks before Dreamforce kicked off, the CRM leader added solutions to AppExchange aiming to help customers take advantage of a massive and increasingly integrated ecosystem. Those span Commerce, Sales, Service and Marketing clouds as the Customer 360 strategy grows through organic development and acquisitions.

At the conference, Salesforce will formally introduce its channel to new AppExchange products, including several billing apps and CPQ options, Einstein Bots and Robotic Process Automation, and a few AI-powered marketing solutions leveraging last year's acquisition of Datorama.

Those capabilities can be a boon for consulting partners, allowing them to seize a bigger piece of the enterprise software spend. Salesforce hopes consultancies will see getting trained and certified on new AppExchange solutions as an opportunity to grow their practices.